In today’s digital world, businesses are increasingly vulnerable to fraud. From phishing, smishing and vishing to account takeover fraud, many other types of fraudulent activities can occur. And while some fraud is easy to spot, other types can be much more challenging to detect. For most organisations it is essential to understand what fraud is, how it works, and how you can protect your business from it.

A way in which businesses can protect themselves from fraudsters is by using a fraud score. But what exactly is a fraud score? In this blog post, we’ll explain what a fraud score is and how it works.

Table of Contents

ToggleWhat is Fraud Score?

A fraud score is a numerical value that indicates the risk level of a particular transaction. Fraud scores are used by businesses to help them identify which transactions or customers are more likely to be fraudulent. The higher the fraud score, the more likely it is that the transaction is fraudulent.

Unlike credit scores, which are based on an individual’s credit history, fraud scores are based on a variety of factors, including the type of transaction, the amount of money involved, the location of the transaction, and whether the customer has a history of fraud. Fraud score logic dictates that businesses should be more cautious of transactions with high fraud scores and may choose to decline or cancel them.

Fraud prevention software like aiReflex uses machine learning to calculate fraud scores. This means that the software gets smarter over time and is more accurate in identifying fraudulent transactions.

How does Fraud Score work?

In order to set a fraud score, businesses first need software that can collect and analyse data. This software is known as a fraud detection system. Fraud detection systems use classification technology with AI (artificial intelligence) to identify patterns in customer behaviour that may indicate fraud.

Once the data has been collected, AI will analyse it through a series of rules the business has set. For instance, a company may set a rule that any transaction over $1000 being made from a country where the user doesn’t typically have transactional behaviour, will automatically be given a high fraud score.

After the data has been analysed, the software will generate a report that includes the fraud score for each transaction. The scoring model can be customised as per the business requirement. The business can then use this information to go through a manual review and decide whether to move forward with the transaction.

Importance of Fraud Scoring

There are plenty of reasons to integrate a fraud score into your business. First and foremost, it can create more customer satisfaction and retention, it can also help you save time and money. By using anti-fraud software, businesses can automate the process of fraud detection and prevention. This means that you can spend less time manually reviewing transactions and more time growing your business.

Fraud can be costly for businesses. Not only do you have financial loss but also there will be higher customer friction. Fraud scoring can help you stay away from fraud by identifying high-risk transactions before they go through.

As for your customers, they’ll appreciate the extra security measures you’ve put in place to protect their information and assets. In today’s day and age, fraud is becoming more and more common. By using a fraud scoring system, you can give your customers peace of mind by knowing that their information is safe.

How to calculate Fraud Score?

There are different ways to calculate a fraud score, depending on your software. Generally, your software will consider a variety of factors when calculating a fraud score. This may include, but is not limited to:

Historical data: Has the customer ever been involved in fraud before? Does their email address domain match that of a known spammer on a blacklist?

Transaction data: What is the amount of money being spent? What type of product is being purchased? Where is the transaction taking place?

Customer data: Does the customer’s name match the billing address? Is the shipping address in a high-risk country?

IP address: Is the IP address associated with any known fraudsters? Does it match the customer’s usual location?

Device ID: Is the device being used to make the purchase a known fraudster’s device? Or is it the customer’s usual device?

All these factors hold a certain ‘weight’ and are given a score. The total sum of these scores is the customer’s fraud score. Of course, you can also choose to manually review each transaction and make a judgment call on whether it’s fraud. However, this is time-consuming and may not be feasible for businesses that have high volumes of transactions.

Fraud Scoring Process

The fraud scoring process is relatively simple, especially if you’re using anti-fraud software. Here’s a quick overview of how it works.

Set default rules

Before you can start scoring transactions, you’ll need to set some default rules. The software will use these rules to score transactions automatically. You can always change these rules later, but it’s a good idea to have some starting point.

You’ll want to group your rules into multiple categories to prevent false positives. That way, if one rule is triggered, it doesn’t necessarily mean the transaction is fraudulent.

Set custom rules

If you want to go a step further, you can also set up custom rules. These rules can be as specific or general as you want. Custom rules are based on specific criteria that you can set, such as the customer’s IP address or the type of transaction.

Custom rules are a great way to fine-tune your fraud scoring process and prevent false positives. You’ll need to provide a point value for each rule, which will be used to calculate the customer’s fraud score.

Set machine learning rules

An effective and worthwhile anti-fraud software will also use machine learning to score transactions. This is because machine learning algorithms can account for various factors, including historical data and behavioural patterns.

Machine learning uses both white-box and black-box methods. White-box methods are transparent, so you can see how the algorithm works and what factors it considers. Black-box methods are opaque, so you can’t see how the algorithm works. However, black-box methods can catch fraudsters using sophisticated methods to commit fraud that has not previously been seen.

Request more information

In some cases, you may not have enough information to make a judgment on whether a transaction is a fraud. In these cases, you can request more information from the customer. This may include asking for additional verification documents or requiring the customer to answer questions about the purchase.

The more information you have, the easier it will be to judge whether the transaction is fraudulent.

Go live

Once you’re confident about using an ML algorithm with AI for fraud scoring, you can go ahead and start using it for all your transactions. When a customer signs up or makes a purchase, their activity will be automatically cross-checked against your rules and given a fraud final score.

If the customer’s fraud score is above a certain threshold, you can choose to flag the transaction for manual review. Alternatively, you can decide to decline the transaction automatically.

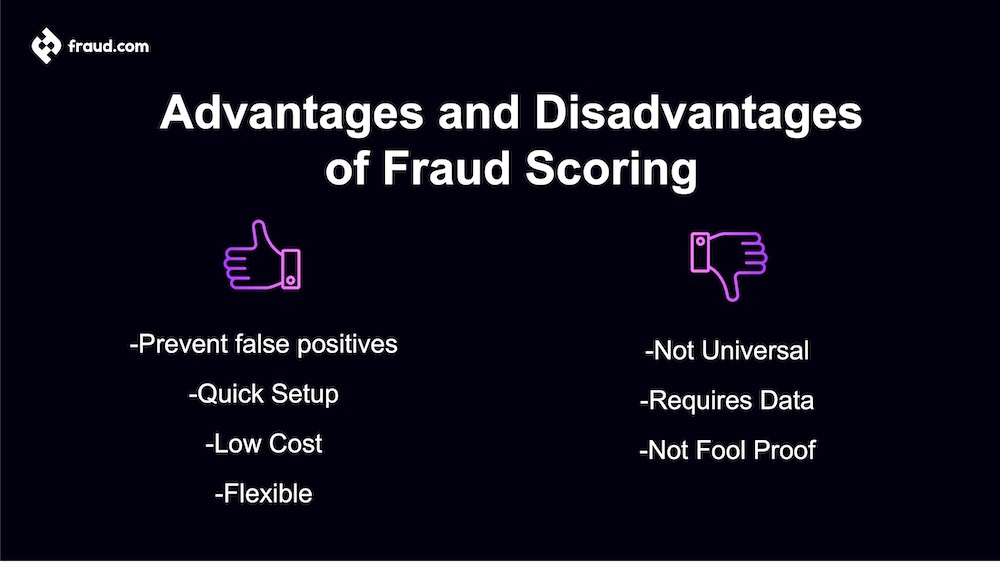

Advantages and Disadvantages of Fraud Scoring

It’s important to understand that no system is perfect, and that includes fraud scoring. It can help to weigh the advantages and disadvantages of using this method to help you decide if it’s right for your business. Let’s evaluate the benefits of fraud scoring.

Advantages of Fraud Scoring

Quick setup: Fraud scoring can be quick and easy to set up. Setting or removing rules is done intuitively and in real time through a dashboard. Your dashboard will also show you the fraud score of each transaction. Automation is also available to free up your time.

Prevent false positives: By using multiple rules and machine learning, you can prevent false positives and catch more fraudsters. Without these extra protection layers, you risk approving fraudulent transactions or declining legitimate ones. This can ultimately frustrate customers and as a result you may lose them.

Low cost: Fraud scoring is a relatively low-cost solution, especially when compared to the loss of revenue caused by fraud. Plus, if customers start avoiding your business because of false declines, you’ll end up losing even more money.

Flexible: Fraud scoring is flexible and can be customised to your specific needs. Fraud changes over time and new fraud trends emerge. Machine learning algorithms can quickly detect new fraud patterns and adapt to them. You can set custom rules and adjust the parameters of your machine-learning algorithms to get the most accurate results.

Disadvantages of Fraud Scoring

Not universal: If you have multiple businesses or operate in multiple countries, you might need separate fraud scoring systems for each one. This can be slightly time-consuming and more expensive to set up and maintain.

Requires data: For fraud scoring to work optimally, you need data. This means you need to have a certain number of transactions before you can use it. If you’re just starting out, you may not have enough data to train your machine-learning algorithms. In this case, you may want to consider using a third-party service with more data access.

Not fool proof: No matter how many rules you set or how sophisticated your machine learning algorithms are, there’s always a chance that some fraud will slip through the cracks. However, by using multiple layers of protection, you can minimise the amount of fraud that gets through.

Our Fraud Scoring System – aiReflex

If you’re looking for a fraud scoring system, look no further than aiReflex. aiReflex uses white-box AI to analyse transactions and behavioral patterns in real-time to identify fraudulent transactions.

Our solution takes care of fraud risk scoring with AI & ML models that are constantly learning and evolving. We also provide an intuitive rules design editor, so you can customise your fraud protection. Plus, our automation features allow you to set and forget rules, taking one more task off your plate.

The real-time dashboard allows you to monitor your fraud score and transactions through an intuitive interface. You can also see which rules are being triggered and adjust them as needed. You’ll find our explainable AI features helpful in understanding why a transaction was flagged as fraud.

Contact us today if you’re interested in learning more about our fraud scoring system or other products. We’ll be happy to answer any of your questions you may have and set you on the path to better fraud protection.