As digital technology evolves, businesses face growing pressure to verify identities quickly and securely. eKYC – electronic Know Your Customer – offers a powerful solution that changes how companies confirm identities and fight fraud and financial crime. With more industries going digital, e-KYC improves security while simplifying the customer experience.

This article breaks down how eKYC works in practice, showing how it reshapes identity verification and raises the bar for fraud prevention. Let’s explore how e-KYC helps organizations handle the challenges of modern identity management with confidence and efficiency.

Table of Contents

ToggleWhat is eKYC (electronic Know Your Customer)?

As digital transformation reshapes industries, understanding e-KYC becomes essential for businesses wanting faster, safer identity checks. Electronic Know Your Customer (e-KYC) is a digital method that verifies customer identities quickly and securely. Unlike traditional paper-based KYC, which can be slow and error-prone, eKYC uses modern technology to simplify and speed up the process.

eKYC combines tools like biometric authentication, Optical Character Recognition (OCR), Near Field Communication (NFC), and real-time data verification. Together, these technologies capture, analyze, and confirm customer details with high accuracy. By digitizing verification, eKYC reduces fraud risks, ensures compliance with regulations, and cuts operational costs.

For businesses focused on smooth customer experiences and strong fraud protection, eKYC is a key solution. It speeds up onboarding while building trust in the digital world. In this section, we explore how e-KYC works and why it’s becoming central to the future of identity verification.

How does eKYC work?

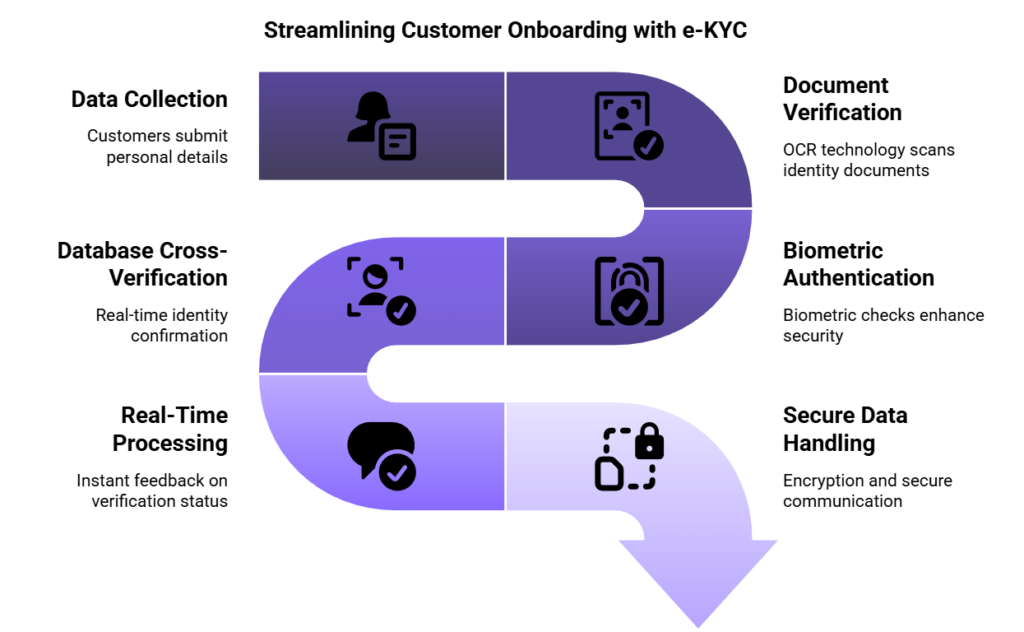

eKYC combines advanced technologies and smooth processes to deliver fast, secure identity verification. Here’s how it transforms customer onboarding step-by-step:

- Data Collection: Customers submit key personal details, such as name, date of birth, address, and identification documents, through web portals or mobile apps, making the initial step quick and convenient.

- Document Verification: Optical Character Recognition (OCR) technology scans identity documentation like passports, driver’s licenses, or national IDs to check their authenticity. This automated verification speeds up the digital process and reduces errors by ensuring documents are genuine and unaltered.

- Biometric Authentication: Biometric checks, such as fingerprint or facial recognition, compare the customer’s biometrics with their submitted documents. This adds an extra layer of security against identity fraud.

- Database Cross-Verification: The system cross-checks customer data against trusted databases, like government records and credit bureaus, to confirm the identity in real-time.

- Real-Time Processing: Customers receive instant feedback on their verification status, drastically reducing onboarding time compared to traditional methods.

- Secure Data Handling: The system encrypts sensitive customer information and uses secure communication channels throughout the process to protect privacy and ensure compliance with data protection regulations.

By following these steps, e-KYC delivers a verification process that is efficient, cost-effective, and highly secure. This blend of technology and user-friendly design is reshaping identity verification today.

What are the benefits of eKYC?

Electronic Know Your Customer (eKYC) offers numerous benefits across various industries. It digitally transforms traditional Know Your Customer (KYC) processes by leveraging technology to streamline identity verification.

These are the key benefits of eKYC:

Speed and Efficiency: eKYC accelerates the identity verification process compared to traditional KYC. While traditional methods can take days or even weeks, e-KYC verifies a customer’s identity in minutes or even in real time. This speed boosts operational efficiency and enables businesses to onboard customers much faster.

Cost Reduction: eKYC automates the verification process and reduces operational costs. It minimizes the need for manual labor, physical document storage, and extensive branch networks. For example, banks can reduce onboarding costs by over 70% by eliminating manual KYC.

Enhanced Security and Fraud Prevention: e-KYC uses advanced technologies like biometrics (facial recognition, fingerprint, iris scanning), artificial intelligence, machine learning, document authentication (OCR), and liveness detection to verify identities securely. These tools help prevent identity theft and financial fraud and detect suspicious activities. They also add a strong layer of security to digital transactions.

Improved Customer Experience and Accessibility: eKYC provides a faster, more convenient, and seamless onboarding experience. Customers can complete the verification process remotely from anywhere with internet access, removing the need for physical visits or document submissions. This improved accessibility is especially valuable for people in remote areas and supports 24/7 access.

Seamless Regulatory Compliance: eKYC helps businesses, especially financial institutions, comply with regulations such as Anti-Money Laundering (AML) and KYC laws. It automates compliance checks and lowers the risk of regulatory fines. Real-time checks against databases like sanction lists further strengthen compliance.

Scalability: eKYC solutions scale efficiently, allowing businesses to manage growing volumes of customer verifications. This capability is essential for rapidly expanding companies and digital platforms with large user bases.

Reduced Paperwork and Errors: eKYC digitizes the verification process, eliminating the need for physical documents and manual handling. Automation reduces human errors common in manual verification and increases accuracy.

eKYC delivers substantial advantages in security, efficiency, compliance, cost savings, and customer experience. These benefits extend across various sectors, including banking and financial services, healthcare, e-commerce, telecommunications, and government services.

Common challenges in e-KYC implementation -and how to overcome them

Implementing Electronic Know Your Customer (eKYC) processes offers significant benefits, but it also presents several challenges. These challenges span technical, regulatory, operational, security, and user experience areas. However, with the right strategies, businesses can overcome them effectively.

Technical Challenges

Integration with Existing Systems: Older IT infrastructure often lacks the compatibility needed to support modern e-KYC technologies. This makes integration time-consuming and resource-intensive.

Solution: Use platforms that offer robust API integrations to connect eKYC with essential systems like CRM, payment gateways, and customer support tools. Choose providers with simplified integration tools and user-friendly setup wizards.

Scalability: As a business grows, so does the volume of customer data. Without a scalable system, performance can suffer.

Solution: Adopt cloud-based KYC platforms that scale efficiently with business growth, eliminating the need for heavy infrastructure investments.

Technological Barriers for Users: Not all customers have access to compatible devices or reliable internet connections.

Solution: Design cross-platform solutions optimized for various environments, including low-bandwidth areas. Provide multiple access channels and consider offline capabilities where needed.

Regulatory Challenges

Varying and Evolving Regulations: Different regions have diverse and frequently changing eKYC laws. Staying compliant across jurisdictions is complex.

Solution: Collaborate closely with legal and compliance teams to ensure adherence to all relevant regulations. Use compliance management tools for automated monitoring and reporting. Select vendors experienced in international standards such as FATF, GDPR, and eIDAS, and ensure your system can adapt to both automated and manual verification methods where required.

Keeping Up with Regulatory Updates: Regulations change frequently, requiring constant system updates.

Solution: Use compliance tools that provide real-time updates on regulatory changes. Conduct regular audits and reviews of your eKYC system to maintain compliance.

Operational Challenges

Process Alignment: Solution: Review current processes before implementation to identify and resolve bottlenecks. Ensure all departments understand and support the new system.

Staff Training: Employees must learn to use new systems, recognize fraud, and provide smooth customer support.

Solution: Offer training programs covering system use, data protection, fraud detection, and customer interaction policies.

Change Management: Resistance to new processes is a common obstacle.

Solution: Develop a strong change management strategy that includes clear communication, employee engagement, and continuous support. Highlight the long-term benefits of eKYC.

Security and Fraud Prevention Challenges

Cybersecurity Threats and Data Breaches: Storing sensitive data makes eKYC systems a prime target for hackers.

Solution: Use strong encryption for data storage and transmission. Implement secure cloud storage, multi-factor authentication, and access controls. Conduct regular security audits and monitor for vulnerabilities.

Deepfake and Synthetic Identity Fraud: Fraudsters can use AI to create convincing fake identities or bypass biometric checks.

Solution: Integrate multiple layers of security. Use advanced liveness detection that requires real-time user interaction. Employ AI-driven image analysis and behavioral analytics to identify anomalies. Combine various verification methods, including document checks, biometrics, and security questions.

False Positives and Negatives: Imperfect algorithms may mistakenly flag legitimate users or miss fraudulent ones.

Solution: Use advanced machine learning algorithms that refine accuracy over time. Leverage broad document template libraries and expert system knowledge to verify diverse documents. Deploy comprehensive fraud detection systems.

User Experience and Trust Challenges

Customer Hesitancy and Privacy Concerns: Some customers hesitate to share personal or biometric data due to privacy fears.

Solution: Enforce strong data protection measures and comply with privacy laws. Communicate clearly how customer data is used and protected to build trust. Design intuitive, transparent interfaces that guide users through the process smoothly.

Maintaining a Seamless Experience: Automation can reduce time, but a poor user interface may lead to frustration or drop-offs.

Solution: Create a frictionless experience by automating tedious steps like data entry and document capture, and optimizing the user journey across devices.

Initial Setup Costs: Implementing eKYC can require a significant initial investment in technology, training, and process changes.

Solution: Choose scalable, cost-effective solutions suited to your business size. Consider cloud-based platforms that reduce upfront infrastructure costs. Evaluate the long-term return on investment through increased efficiency and lower operational expenses.

While eKYC implementation comes with challenges, businesses can overcome them through thoughtful planning, robust technology, and effective change management. By addressing these issues, organizations can unlock the full potential of eKYC, delivering faster onboarding, stronger security, streamlined compliance, and an improved customer experience.

eKYC vs. KYC: Key differences

As businesses work to strengthen security and improve the customer experience, it’s important to understand how electronic KYC (eKYC) differs from traditional KYC processes. While both aim to verify identities, the way they operate, and the results they deliver, are significantly different. Here’s a closer look at how the two approaches compare:

Process Efficiency

Traditional KYC involves manual steps, including collecting paper documents and conducting in-person checks. This often slows down onboarding and creates friction for both customers and staff.

eKYC simplifies this by moving the process online. With digital forms, automated verification, and instant data checks, businesses can onboard customers much faster, with fewer delays and less manual work.

Accuracy and Security

Manual processes leave room for human error and inconsistencies. People can lose, mishandle, or tamper with physical documents, which raises security concerns

In contrast, eKYC uses technologies like biometrics and AI to verify identities with greater precision. The system encrypts and processes data securely, reducing the risk of fraud or unauthorised access.

Customer Experience

With traditional KYC, customers often need to visit a branch, bring original documents, and wait for approval, sometimes more than once.

eKYC removes these barriers. Customers can verify their identity from anywhere using a mobile app or website and usually receive updates in real time. The result is a smoother, faster, and more convenient experience.

Scalability and Adaptability

Scaling a manual process takes time, resources, and infrastructure, making it hard to keep up with growing demand or regulatory change.

Digital systems, on the other hand, scale easily. eKYC platforms can handle large volumes of users, adapt to new compliance rules, and support remote onboarding across regions.

Cost Implications

Traditional KYC can be expensive. Paperwork, physical storage, manual reviews, and staff training all add up, making the process costly and time-consuming.

While eKYC requires upfront investment in digital tools, it quickly pays off. Automated checks reduce the need for manual labour, cut down paper use, and lower operational costs in the long run.

By comparing these two approaches, it’s clear that eKYC not only modernises identity verification, it also aligns better with today’s business priorities: speed, security, compliance, and customer satisfaction. For companies embracing digital transformation, eKYC is more than just a convenient upgrade, it’s a strategic advantage in managing identity and preventing fraud.

The future of eKYC

As digital transformation reshapes every sector, fast, secure, and scalable identity verification is becoming essential. Electronic Know Your Customer (eKYC) is no longer just an innovation, it’s the new standard.

By streamlining onboarding, reducing costs, enhancing fraud prevention, and ensuring regulatory compliance, eKYC offers advantages that traditional KYC methods can’t match. While challenges exist, ranging from integration and user access to regulatory complexity, organizations that invest in robust, flexible solutions will overcome them and gain a competitive edge.

The future of eKYC lies in smarter automation, stronger security frameworks, and even more seamless user experiences. As artificial intelligence, biometrics, and real-time data verification continue to evolve, eKYC will play a central role in shaping trust in the digital economy.

For businesses navigating today’s digital landscape, adopting eKYC isn’t just about compliance, it’s about building resilience, earning customer trust, and preparing for what’s next.