Pro AML

Pro AML is an advanced technology platform designed to help financial institutions combat money laundering and the financing of terrorism (AML/CFT). It is fully compliant with FATF (Financial Action Task Force) recommendations and automatically fulfills regulatory requirements using artificial intelligence technologies.

Discover Our Cloud-Based AML Monitoring Solution

Equipped with Advanced Features.

*Fees are charged monthly in advance. Prices exclude VAT.

Critical Global Watchlists

Critical global watchlists, such as those from OFAC (including the SDN and Consolidated Non-SDN lists), the United Nations (UN), the European Union (EU), and the UK’s HM Treasury (HMT), are updated in near real-time.

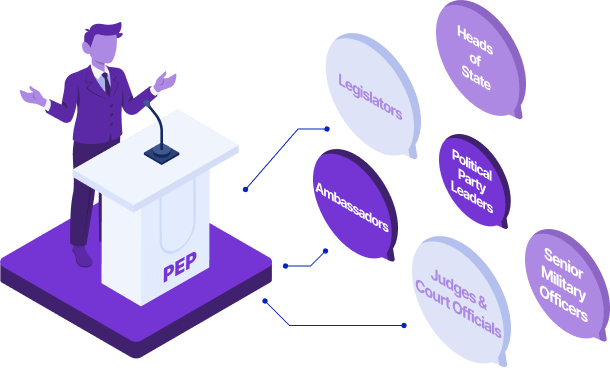

Politically Exposed Persons (PEP)

In accordance with FATF recommendations, all categories of Politically Exposed Persons (PEPs)—such as politicians, members of the judiciary, senior military officials, and senior executives of state-owned enterprises (SOEs)—and their Relatives and Close Associates (RCAs) are screened across more than 230 countries.

Criminal and

Law Enforcement Watchlists

High-risk individuals are identified by screening wanted lists from international and national law enforcement agencies, such as Interpol Red Notices, Europol’s Most Wanted list, and watchlists from the FBI and DEA.

Adverse Media

By screening thousands of global news sources, regulatory filings, and other publications, hidden risks are uncovered (such as involvement in corruption, fraud, or other illicit activities) that may not appear on official watchlists.

Local Expertise

Pro AML is continuously updated to comply with local regulations and directives concerning the financing of terrorism and the proliferation of weapons of mass destruction, as issued by the relevant national authorities.

Problem

Instead of bypassing systems, attackers now directly target users, deceiving them with social engineering methods to make them approve fraudulent transactions themselves. Furthermore, through malware such as Remote Access Trojans (RATs), attackers can remotely access a victim’s device, perform all transactions as the legitimate user, and bypass traditional security controls.

Mobile channels, in particular, pose a higher risk due to increasing trojan and malware activities and advanced fraud techniques. Existing fraud detection systems are often insufficient in detecting these advanced attack types, as they mostly focus only on the user’s identity and transaction details, without analyzing how the transactions are performed. Therefore, in the evolving threat landscape, there is a need for innovative and advanced technologies like behavioral analysis for effective protection.

Pro AML Technical Specifications

Comprehensive Data Network

Protect your business against financial crimes with Pro AML's extensive data network and comprehensive screening capabilities. Maximize your compliance processes.

Monitor all critical global watchlist and sanctions lists in near real-time.

Achieve comprehensive coverage with data from over 230 national and international countries and jurisdictions.

Manage your risks with an extensive and detailed Politically Exposed Person (PEP) database.

Reduce false positives by differentiating between individuals with similar names, enhancing identity accuracy, and accelerating the review process.

Screen for Adverse Media from over 60,000 global sources.

Gain complete risk visibility by analyzing critical data from sources like Europol, Interpol Red Notices, and the FBI's Most Wanted list.

With our Premium List Options, we go beyond standard watchlists by partnering with the industry's leading data providers to deliver the most in-depth risk analysis. These integrations provide you with unparalleled data superiority:

A rich resource covering more than 1,100 databases.

A massive data pool sourced from over 300 sanctions programs and more than 10,000 global sources.

Enables in-depth analysis with the Orbis database, containing over 450 million companies and their ownership structures. This data helps map complex ownership chains to uncover Ultimate Beneficial Owners (UBOs) and identify hidden risks against sanctions lists.

The Bloomberg Terminal integrates real-time market data with sanctions and PEP lists. It provides instant and reliable adverse media monitoring, powered by over 2,700 journalists from Bloomberg News in more than 120 countries.

With Premium Lists, you can access additional information that goes beyond the reach of conventional systems.

Uncover the hidden and complex ownership structures of sanctioned entities.

Identify sector-specific restrictions in detail.

Individual Due Diligence (KYC)

In the context of Anti-Money Laundering (AML), Know Your Customer (KYC) for an individual is the process of verifying their identity and holistically assessing their financial crime risk profile. This process involves checking the individual's:

(e.g., Interpol Red Notices, Europol's Most Wanted list, and other national wanted lists) is checked.

Pro AML is continuously updated to comply with local regulations and directives concerning the financing of terrorism (CFT) and the proliferation of weapons of mass destruction (PF), as issued by the country’s Financial Intelligence Unit (FIU) and other relevant national authorities.

Corporate Due Diligence (KYB)

In the context of AML, Corporate Due Diligence (also known as Know Your Business (KYB) ) is a comprehensive review conducted by obliged entities to identify and verify a corporate customer. This process is mandated by national AML/CFT legislation, which is based on global standards set by bodies like the FATF.

The process begins with verifying the legal existence of the entity, followed by the most critical step: identifying the Ultimate Beneficial Owner (UBO). According to international AML standards, a UBO is generally defined as the natural person(s) who ultimately owns or controls more than 25% of the company’s shares or voting rights, or who otherwise exercises ultimate effective control.

Both the corporate entity itself and all identified Ultimate Beneficial Owners—as well as their key representatives (e.g., board of directors, authorized signatories)—are individually screened against sanctions lists, PEP lists, criminal watchlists, and adverse media records. The objective is to uncover risks concealed within corporate structures and to prevent the entity from being used for financial crimes.

Business Registry Check

This feature provides real-time access to all critical legal, financial, and corporate data that constitutes a company's official identity within its registered jurisdiction.

This check allows for the instant retrieval of a company's fundamental information, such as its official registration number, legal name, and date of incorporation, as well as details on its total capital, ownership structure, share distribution, and current directors, representatives, and auditors. Furthermore, it can be used to verify the company's NACE codes (indicating its business activities), active branches, and significant legal statuses, such as bankruptcy or insolvency proceedings.

By offering a single point of access to a company's most current and official information, this feature ensures transparency and security throughout Know Your Customer (KYC) and Know Your Business (KYB) processes, as well as in commercial transactions.

Continuous Business Registry Monitoring

Continuous Business Registry Monitoring is a proactive risk management feature that goes beyond a one-time check, allowing you to constantly monitor the official registry records of the companies you are tracking.

With this feature, any change filed with the business registry—such as modifications to the ownership structure, the addition of a new shareholder, the departure of an existing partner, or changes in directors or capital—is tracked in real-time.

Whenever the system detects a change in the registry data of a monitored company, it sends an instant notification to prompt action. Based on the type of change (e.g., change in ownership, address update, etc.), predefined automated actions can be triggered. This allows for the immediate identification of significant shifts in a customer's risk profile, enabling effective lifecycle management of your Know Your Business (KYB) processes.

Adverse Media Screening

In the context of Anti-Money Laundering (AML) and Know Your Customer (KYC), Adverse Media Screening is a form of open-source intelligence used to assess the reputational and potential risks of an individual or legal entity. The process involves screening the customer, their Ultimate Beneficial Owners (UBOs), and key executives across global and local media sources to determine if they have been linked to illicit activities such as money laundering, terrorism financing, fraud, or corruption.

While the term may not be explicitly mandated in all national AML regulations, the practice is a de facto requirement for implementing the Risk-Based Approach (RBA). Fulfilling the obligations of Enhanced Due Diligence (EDD), which is mandatory for high-risk customers, is virtually impossible without conducting these checks.

Therefore, adverse media screening is a critical, global best practice that complements static list checks (such as sanctions and PEP screening), enabling institutions to fully meet their regulatory obligations.

Enhanced Due Diligence (EDD)

In the context of Anti-Money Laundering (AML), Enhanced Due Diligence (EDD) is an advanced level of scrutiny and monitoring applied to high-risk customers and transactions for which standard Customer Due Diligence (CDD) measures are deemed insufficient.

National AML/CFT regulations, guided by the Risk-Based Approach (RBA), mandate that obliged entities apply these enhanced measures. When customers are classified as high-risk—such as Politically Exposed Persons (PEPs), companies with complex corporate structures, or those operating in high-risk jurisdictions—the due diligence process must extend beyond standard identity verification.

The EDD process involves a detailed investigation into the customer's source of wealth (SoW) and source of funds (SoF), closer scrutiny of the purpose of the business relationship, obtaining senior management approval, and subjecting transactions to more stringent ongoing monitoring. The objective is to effectively manage and mitigate the heightened risks of money laundering and terrorist financing.

Continuous AML Monitoring

“Move Beyond Static Screening to Dynamic Protection: Continuous Monitoring with AML Pro”

Customer risk is not static; it is dynamic and can change at any moment. A customer who is low-risk today can suddenly become high-risk tomorrow by being added to a sanctions list, appointed to a political position (becoming a PEP), or becoming the subject of adverse media. While traditional AML systems flood compliance teams with unnecessary alerts by scanning the entire customer database daily, periodic KYC/KYB reviews create dangerous "compliance gaps."

AML Pro's Continuous Monitoring Module is a modern compliance approach that puts an end to these outdated and inefficient methods.

Intelligent Event-Based Technology

Instead of periodically screening your entire customer base, our module monitors them 24/7 using intelligent "event-based" technology. The system takes action only when a "triggering event" occurs that changes your customer's risk status. When your customer is added to a sanctions list or a significant change occurs in their risk profile, our system instantly detects it and generates a targeted alert for your compliance team.

Eliminate the dangerous compliance gaps between periodic screenings. Get notified the moment a risk emerges.

Instead of analyzing thousands of unnecessary and redundant alerts, your compliance team can focus its time and energy solely on genuine risks.

Prevent "alert fatigue" by receiving notifications only for significant events, ensuring you never miss a critical update.

Eliminate the system strain, cost, and manual effort associated with constantly scanning your entire database.

Fuzzy Matching

One of the greatest challenges in sanctions screening is the combination of intentional identity obfuscation and inherent data complexity. Minor variations in names, transliterations across different alphabets (e.g., Sergei vs. Sergey), the use of aliases, or simple data entry errors (e.g., Mohammed vs. Mohamed) can easily bypass traditional systems that rely on exact, literal matching.

This is where fuzzy matching (a cornerstone of modern compliance processes) comes into play.

By analyzing phonetic and algorithmic similarities, this technology intelligently identifies non-exact matches, such as spelling variations like "Mohammed" and "Muhammet" or abbreviations like "J.D. Smith" versus "John D. Smith."

Fuzzy matching not only solves the critical issue of false negatives (where a genuine risk is missed) but also significantly reduces the volume of false positives (erroneous matches) that increase operational overhead.

Automated Suspicious Activity Detection

AML Pro's advanced Rule Engine simplifies and automates this complex process for you with out-of-the-box rule sets derived directly from FATF-recommended typologies.

Eliminate the risks that manual checks can miss with AML Pro's intelligent automation.

Red Flags Related to Customer Identity and Profile

Inconsistencies in a customer's behavior and profile are the early warning signs of potential risk.

The customer delays, avoids, or is reluctant to provide the information or documents required for identity verification, or provides misleading/false information.

The customer's transactions are markedly inconsistent with their known profession, income level, business profile, and expected transactional activity.

During transactions, the customer exhibits unusually nervous, anxious, or secretive behavior, or seems intent on concealing information.

Red Flags Related to Transactions

The structure, volume, and purpose of transactions can uncover organized criminal activity.

The transaction lacks a clear legal or economic purpose, or has an unnecessarily complex or unusual structure.

Intentionally breaking down a large sum of money into smaller amounts, designed to fall just under reporting thresholds, and then depositing those amounts into one or more accounts.

An account receives numerous deposits from various domestic and international sources, followed by the rapid transfer of these funds to other accounts with no logical or apparent business purpose.

Consistently structuring transaction amounts to fall just under the legal thresholds that trigger mandatory regulatory reporting.

Powered by rules derived from FATF-recommended typologies and scenarios, the AML Pro Rule Engine instantly detects and flags complex transaction patterns, including smurfing (structuring), anomalous fund flows, and transactions designed to fall just under reporting thresholds.

Terrorism Financing Red Flags

Combating the financing of terrorism (CFT) requires real-time data analysis and the utmost vigilance.

Transactions are linked to individuals, groups, or entities known from public or official sources to be associated with terrorist organizations.

The source, ultimate beneficiary, or purpose of funds sent to or received from non-profit organizations raises serious suspicion, particularly for those operating in high-risk jurisdictions.

Frequent fund transfers are made to or from individuals in jurisdictions known for significant terrorist activity or designated as conflict zones.

In line with FATF recommendations on high-risk factors, AML Pro instantly screens current national and international sanctions lists and data on high-risk jurisdictions. This enables it to detect potential transfers related to terrorism financing with high precision and without delay.

Akıllı Yüz Eşleştirme

Traditional AML solutions are limited to text-based searches. This results in a high volume of false positives caused by similar names, spelling errors, and incomplete information, which burdens compliance teams and can lead to genuine risks being missed.

AML Pro's advanced and intelligent facial recognition technology eliminates false positives and significantly reduces your operational overhead by comparing your customer’s photograph against images on PEP, sanctions, and criminal watchlists.

Facial recognition is particularly effective for automatically and accurately screening official watchlists that contain thousands of photos (such as those from Interpol, Europol, the FBI, DEA, NCA, and other national wanted lists) without requiring any manual review.

Eliminate hundreds of false positives caused by name similarity. Facial recognition maximizes identity accuracy and significantly reduces your compliance team's workload.

By instantly combining facial recognition results with text-based screening data, it enables compliance teams to make faster, more accurate, and more reliable decisions.

Global and local authorities are increasingly adding photos to sanctions lists. AML Pro prepares you for tomorrow's compliance standards and ensures full compliance where traditional, text-based systems fall short.

Gelişmiş Kural Motoru

Pro AML allows your institution to move beyond static policies and create a dynamic defense layer based on its unique risk appetite, customer profiles, and specific operational workflows. Unlike traditional systems, the Pro AML rule engine enables you to build custom scenarios to detect the complex and ever-evolving methods used by financial criminals. Below are some example scenarios you can instantly detect with the rule engine:

Detects the provision of cash for a commission via a POS terminal without any legitimate goods or services. This is identified through patterns like round-figure amounts, split transactions at short intervals, a high rate of manual entries, and subsequent rapid cash withdrawals.

Identifies multiple, small-value transactions designed to stay below legal reporting thresholds, uncovering attempts to launder money through 'structuring'.

Triggers a geographic risk rule for inbound and outbound transfers to countries on the FATF grey/black lists or other high-risk jurisdictions, especially when transactions are frequent, in unusual amounts, or involve intermediary accounts.

Detects when a single beneficiary receives numerous low-value payments from various sources at frequent intervals—a pattern indicative of a common terrorism financing scenario.

Detects sudden and high-volume fund flows that are inconsistent with a customer's transaction history, generating instant alerts for behavioral anomalies.

Monitors funds being transferred to other accounts shortly after being deposited, uncovering 'layering' activities designed to obscure the audit trail.

Identifies complex laundering methods, such as intentionally overpaying invoices or credit card bills and then requesting a refund of the difference.

Identifies large or frequent commercial-style transactions that are inconsistent with the customer's stated business activity (e.g., NACE code), profession, and income profile, instantly flagging logical discrepancies.

Automatically updates a customer's risk score and triggers an immediate review in response to events like new adverse media or relocation to a high-risk country.

Screens against your institution's internal, user-defined watchlists of high-risk individuals or companies, instantly flagging any associated transactions.

Uncovers covert connections like shared addresses, phone numbers, or IP information among different customers to detect organized fraud rings.

Uses network analysis to detect complex 'round-tripping' schemes where funds are moved through multiple shell companies or accounts before returning to the origin.

Generates an immediate alert when a low-risk customer transacts with an individual or entity known to be sanctioned or otherwise classified as high-risk.

Specific to the insurance sector, this rule automatically flags frequent or suspicious changes of a policy's beneficiary, especially to individuals with no apparent relationship to the policyholder.

Batch AML Screening

Batch Screening is a powerful and efficient feature that allows you to screen hundreds or thousands of customer, supplier, or transaction names against sanctions and risk lists in a single operation, without requiring manual effort. This method is specifically designed for institutions with large customer portfolios to automate their compliance workflows.

Pro AML's Batch Screening feature offers the following advantages:

Allows you to prepare and upload your customer or supplier list in a standard Excel file format and initiate the screening process within minutes.

Screen up to 10,000 names at once in a single file, saving significant time and reducing operational costs.

Detailed, downloadable reports are automatically generated for each screened name, providing a complete audit trail for regulatory purposes.

All resulting hits from the screening are automatically consolidated into a single CSV file for easy review, analysis, and archiving.

PEP Classification and Risk Network Analysis

Pro AML goes beyond simply identifying Politically Exposed Persons (PEPs) by segmenting them into detailed categories, allowing you to accurately assess their risk levels. Developed in line with Financial Action Task Force (FATF) recommendations, this classification makes your compliance processes more precise and efficient.

Core PEP Categories:

Pro AML clearly categorizes PEPs based on their role and position, which determine their level of risk:

Heads of state, heads of government, ministers, deputy ministers, members of parliament, and members of the governing bodies of political parties.

Members of supreme courts, constitutional courts, or other high-level judicial bodies.

High-ranking officers in the armed forces, such as generals and admirals.

Members of the board of a central bank, members of courts of auditors, and members of the administrative, management, or supervisory bodies of state-owned enterprises (SOEs).

Ambassadors, chargés d'affaires, and consuls general.

Other senior public officials such as heads of national agencies and prosecutors general.

Pro AML recognizes that risk is not confined to the PEP alone. Therefore, it extends the analysis to their entire associated network:

Automatically screens individuals who could be conduits for illicit funds, such as a PEP's parents, spouse, partner, children, their children's spouses/partners, and close business associates.

Extends coverage to include state-owned enterprises where a PEP holds a senior management or board position, ensuring that associated corporate risks are not overlooked.

This detailed classification allows you to more accurately assess the potential risk posed by each PEP profile, enabling you to focus your Enhanced Due Diligence (EDD) efforts on the right individuals and use your resources most efficiently.

Pro AML Use Cases

Pro AML is a flexible platform that understands the unique AML challenges of different industries and offers tailored solutions to address them.

Banking and Fintech: Pro AML addresses core challenges such as high transaction volumes, real-time payments, and the need for seamless digital customer onboarding. Its speed and automation support growth without sacrificing compliance.

Payment and E-Money Institutions: Addresses the unique risks posed by cross-border payments and the potential for anonymity. Pro AML's global data coverage and network analysis capabilities enable the effective monitoring of complex fund flows.

Crypto-Asset Service Providers (CASPs): Pro AML addresses the intense regulatory scrutiny faced by this sector by offering robust sanctions screening, comprehensive transaction monitoring, and the flexibility to adapt to evolving regulations, such as the EU's MiCA framework.

Insurance: Addresses money laundering typologies unique to the insurance sector, such as early policy surrender and premium overpayment. Pro AML’s continuous monitoring and network analysis capabilities are specifically designed to detect these unique red flags.

FAQ

Anti-Money Laundering (AML) refers to the set of laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. As described in the context of Pro AML, this framework is crucial for combating money laundering and the financing of terrorism (AML/CFT). It requires financial institutions to implement comprehensive compliance programs that are fully compliant with global standards set by bodies like the Financial Action Task Force (FATF). Key components of an effective AML program include Customer Due Diligence, transaction monitoring, and reporting suspicious activities to the relevant authorities.

The fundamental difference lies in the subject of the due diligence process.

KYC (Know Your Customer) focuses on individuals. It is the process of verifying a person’s identity and assessing their individual financial crime risk profile. This involves checking their name against sanctions lists, Politically Exposed Persons (PEP) lists, and criminal watchlists.

KYB (Know Your Business) focuses on corporate entities. It is a more complex process that involves verifying the legal existence of a company and, most critically, identifying its Ultimate Beneficial Owners (UBOs)—the natural persons who ultimately own or control the company. The KYB process requires screening the corporate entity itself, its UBOs, and its key executives against all relevant risk lists.

In short, KYC is about identifying and verifying an individual, while KYB is about understanding a company’s structure to identify the real people behind it.

A Politically Exposed Person (PEP) is an individual who holds a prominent public function, which presents a higher risk for potential involvement in bribery and corruption. In line with FATF recommendations, Pro AML identifies several categories of PEPs, including:

Senior politicians (e.g., heads of state, ministers)

Members of the senior judiciary

Senior military officials

Senior executives of state-owned corporations

Senior diplomats

The risk extends beyond the individual, so screening also includes their Relatives and Close Associates (RCAs), who could be used as conduits for illicit activities.

PEP screening is a mandatory requirement under global AML/CFT regulations because individuals in these prominent positions are more vulnerable to corruption, bribery, and other financial crimes. Regulatory bodies like the FATF mandate a Risk-Based Approach (RBA), which requires financial institutions to identify customers who pose a higher risk.

Because of their influence and position, PEPs are automatically classified as high-risk. Identifying a customer as a PEP triggers the need for Enhanced Due Diligence (EDD), which involves more intensive scrutiny of their source of wealth and funds, and more rigorous ongoing monitoring to mitigate the elevated risk of money laundering.

Official watchlists (like sanctions or criminal lists) are static and confirm that an individual or entity has been formally designated as high-risk by a government or international body. Adverse Media Screening offers a different, more dynamic layer of risk intelligence.

It uncovers potential and reputational risks by screening thousands of global news sources, regulatory filings, and other publications. This can reveal involvement in illicit activities such as fraud, corruption, or terrorism financing that may not have resulted in an official listing yet. As the Pro AML text states, it is a critical practice for implementing a Risk-Based Approach (RBA) and is virtually essential for conducting the Enhanced Due Diligence (EDD) required for high-risk customers.

Pro AML solves the problem that modern financial criminals are bypassing traditional security systems by targeting users directly through social engineering or using advanced malware like Remote Access Trojans (RATs). These methods allow attackers to perform transactions as the legitimate user, making them difficult to detect with systems that only analyze identity and basic transaction details.

Existing systems are often insufficient because they don’t analyze how transactions are performed. Pro AML addresses this gap by providing innovative technologies like behavioral analysis and a sophisticated Rule Engine to detect anomalies and suspicious patterns. It also solves the operational inefficiency of traditional compliance by automating processes, reducing false positives through features like Fuzzy Matching and Face Matching, and eliminating “compliance gaps” with Continuous Monitoring.

obligations.

FATF Compliance: The platform is designed to be fully compliant with FATF recommendations, which are the global standard for AML/CFT.

Real-time Global Watchlists: It provides near real-time updates for critical global watchlists from bodies like OFAC, the UN, the EU, and the UK’s HMT.

Local & Global Adaptability: The platform is continuously updated to comply with directives from national Financial Intelligence Units (FIUs) and other authorities across more than 230 jurisdictions.

Comprehensive Tools: It offers all necessary functions for a robust compliance program, including KYC/KYB, PEP screening, EDD, and a rule engine based on FATF-recommended typologies for detecting suspicious activity.

No, Pro AML is a comprehensive AML platform that goes far beyond simple list screening. While real-time screening against sanctions, PEP, criminal, and adverse media lists is a core feature, its capabilities also include:

Scenario / Rule Engine: Automates the detection of suspicious activities and complex money laundering typologies (e.g., structuring, layering) based on customer behavior and transaction patterns.

Continuous AML Monitoring: Provides dynamic, 24/7 event-based monitoring to detect changes in customer risk status in real-time, rather than relying on periodic checks.

Face Matching: Uses intelligent facial recognition to reduce false positives and enhance identity verification against photo-based watchlists (e.g., Interpol, FBI).

Corporate Due Diligence (KYB): Includes features for identifying UBOs and performing real-time Business Registry Checks and ongoing monitoring.

Dynamic Risk Scoring: Automatically updates customer risk scores based on triggering events.

Yes. Pro AML offers a Batch AML Screening feature designed specifically for this purpose. This allows you to efficiently screen hundreds or even thousands of customer or supplier names in a single operation. You can upload a list in a standard Excel file (up to 10,000 names at once) and the system will automatically screen all names and generate detailed, downloadable reports for audit purposes.

Integrating with Premium Data Providers offers “unparalleled data superiority” and enables a far more in-depth risk analysis than standard watchlists alone. These premium sources provide deeper, broader, and more contextual data that helps uncover hidden risks. The advantages include:

Richer Data: Access to vast databases like Dow Jones (over 1,100 databases) and LSEG World-Check (over 10,000 global sources).

UBO Identification: Using Moody’s Analytics (Orbis), you can map complex corporate ownership structures across 450 million companies to accurately identify Ultimate Beneficial Owners (UBOs).

Real-time Adverse Media: Bloomberg provides instant and reliable adverse media monitoring from a global network of over 2,700 journalists.

Enhanced Sanctions Data: Access to over 54,000 Sanctions Control & Ownership (SCO) records to uncover the hidden ownership of sanctioned entities.

Essentially, premium lists allow you to go beyond basic compliance checks to achieve a truly comprehensive and accurate understanding of customer risk, especially in complex corporate or high-risk scenarios.