One Platform Multiple Solutions

Learn more →

Learn more →

What makes our fraud prevention different

Transactional Orchestration

→ Read More

Adaptive Policy Engine

→ Read More

AI Engine

→ Read More

Journey Time Orchestration

→ Read More

Dynamic Case Management

→ Read More

Threat-Centric Cases

→ Read More

Transaction Orchestration

It’s not uncommon for a fraud defence to be fragmented; maintaining a well-balanced, fine-tuned risk and trust assessment requires all the pieces of the puzzle.

Transaction orchestration reduces unnecessary overheads by delivering standard interfaces to collect transaction and event parameters from underlying fraud, cyber and identity solutions. The results are then collected and combined to produce a powerful final risk score.

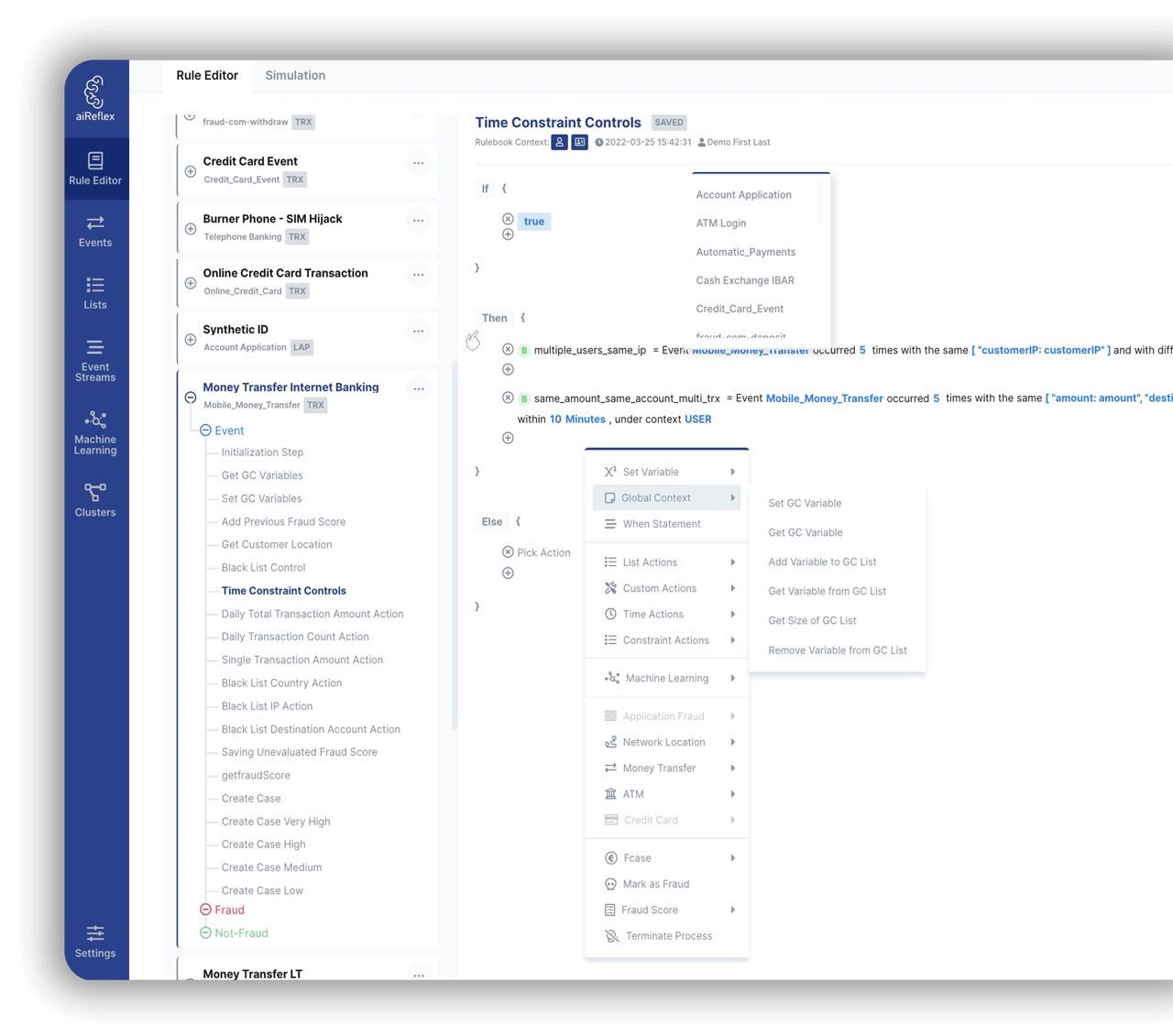

Adaptive Policy Engine

Machine learning is vital in the fight against fraud; however, rules are still essential for fraud prevention today. Fraud professionals can use rules to stop a new fraud attack quickly whilst it’s happening and before an ML model adapts or temporarily use rules for a new business channel before an effective ML model.

aiReflex rules are adaptive, working closely with our behavioural engine and feedback loops or equally on their own or across business channels to deliver a next-generation rule engine.

Rule Editor

With drag-&-drop context-aware features,

Supporting inter-channel adaptive rules,

Powerful statistical function and time series analysis,

Works in conjunction with the behavioural models,

All with sandbox testing and 4-eye+ control.

IF you can imagine it, THEN you can do it.

Rule Safeguards

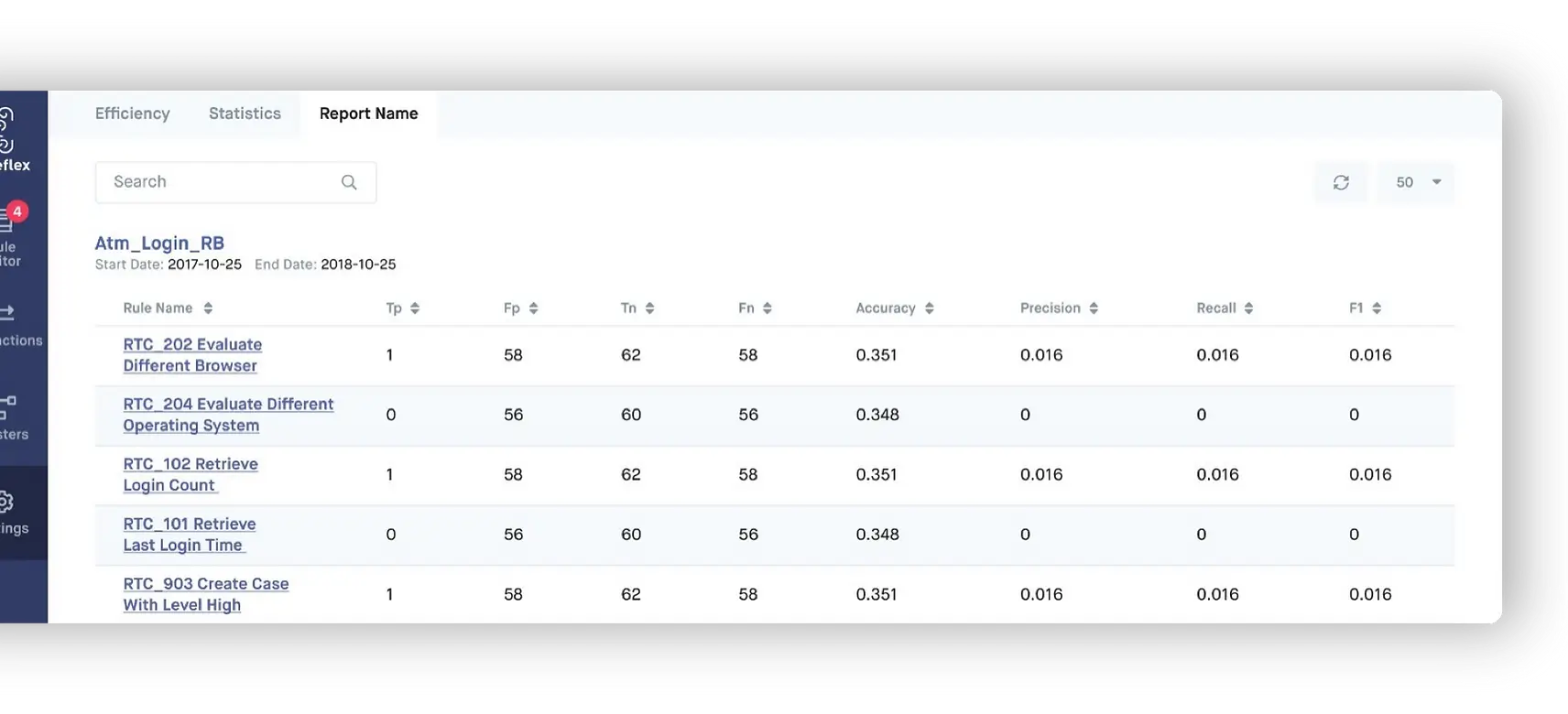

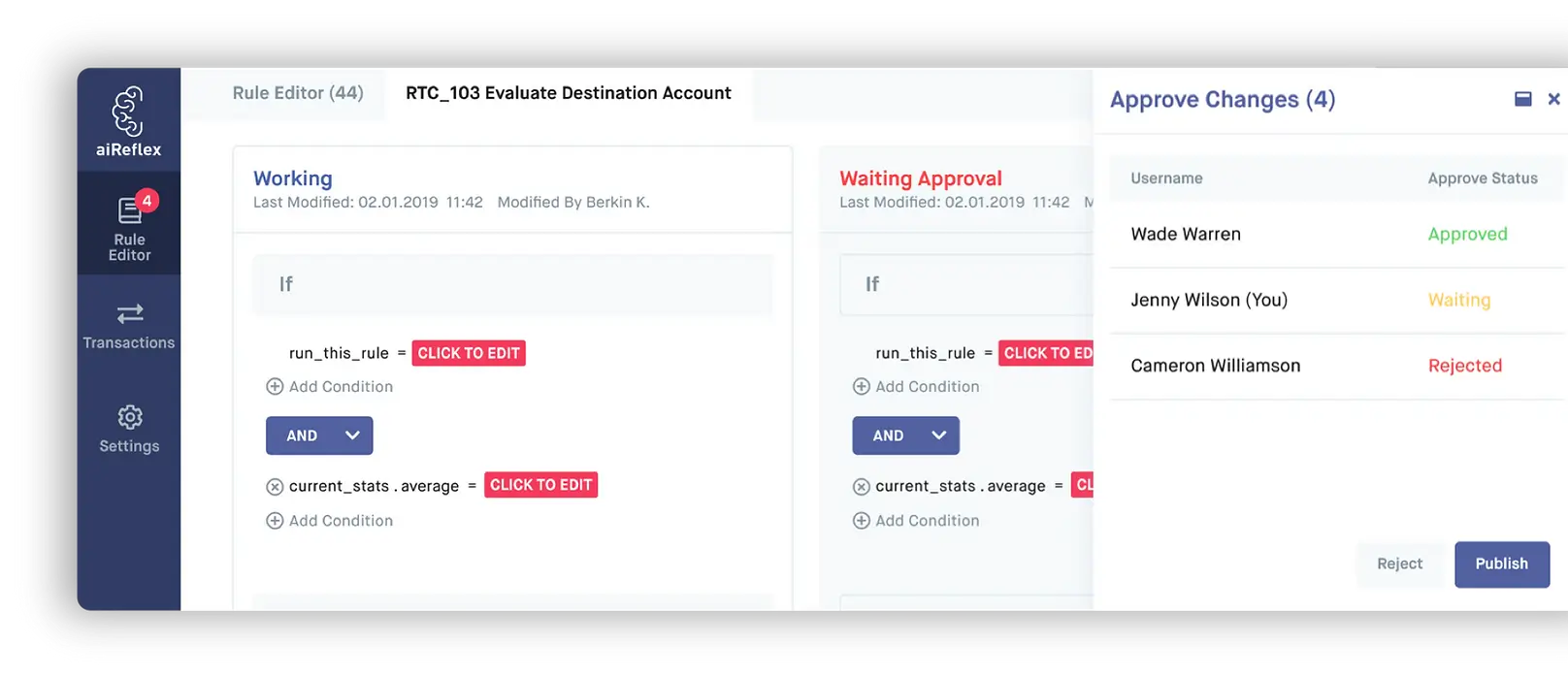

We understand rules are beneficial, as mentioned above; however, they can also be problematic if used in the wrong way, so we’ve developed safeguards to enable fraud professionals to learn more about the impact of potential rules before deploying ↓

Rule

Performance Analyser

Rule

Approval Control

Our AI Engine

aiReflex determines which transactions are legitimate in real-time using a multi-layer defence coupled with explainable AI to fight fraud and improve customer trust.

Our ready-to-go AI engine conducts a detailed analysis of your transactional data in real-time to deliver unmatched risk scoring accuracy.

The multi-layer defence identifies suspicious transactions using our adaptive machine learning algorithms and next-generational behavioural engine to create hyper granular profiles for every individual to identify abnormal behaviour.

+ Open model architecture

+ Explainable AI

+ Sandbox Simulation

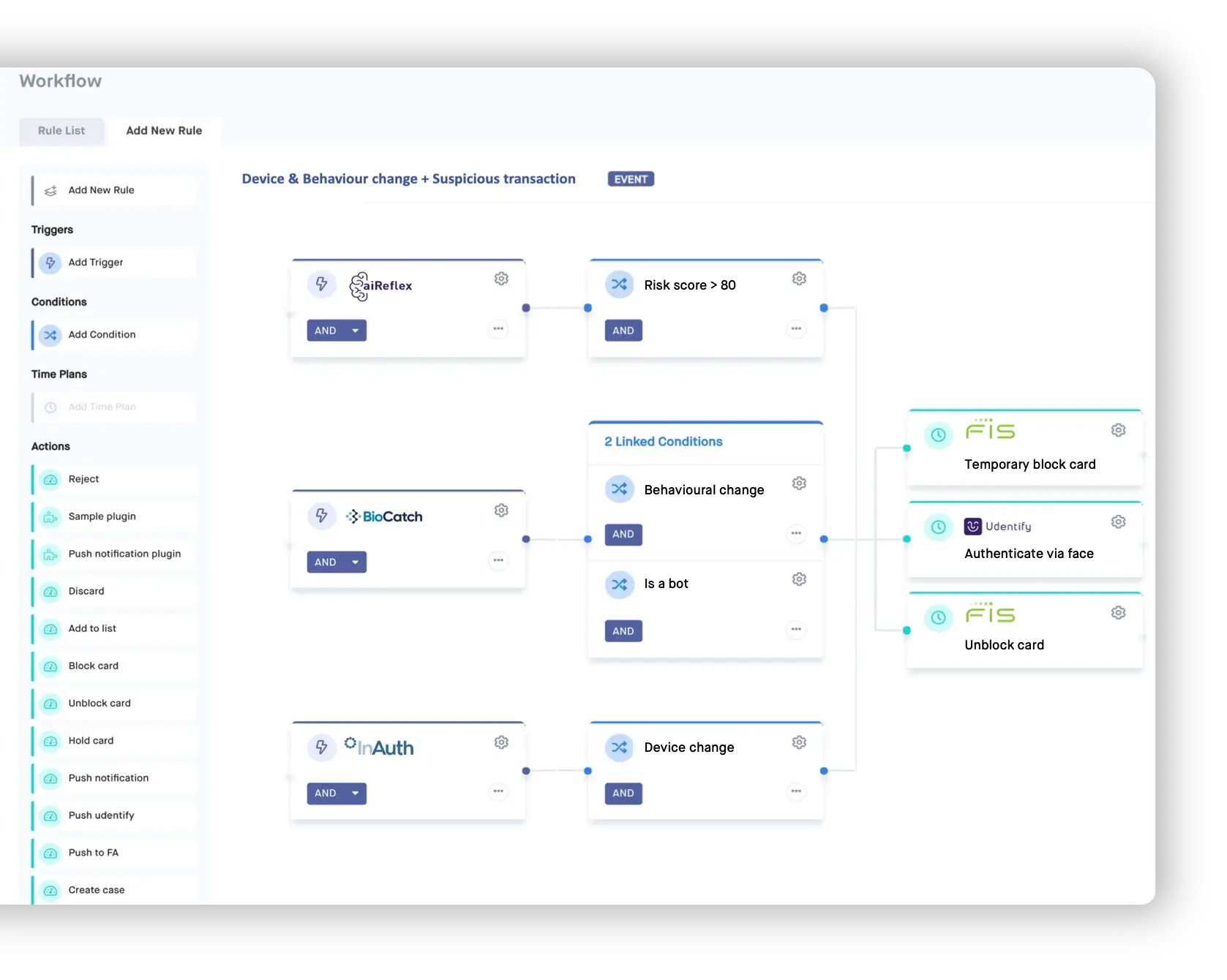

Journey-Time Orchestration

Our real-time, drag-&-drop workflow editor automates your repetitive operational tasks and unites your systems to deliver continuous adaptive risk and trust assessments to protect your customers and reduce friction.

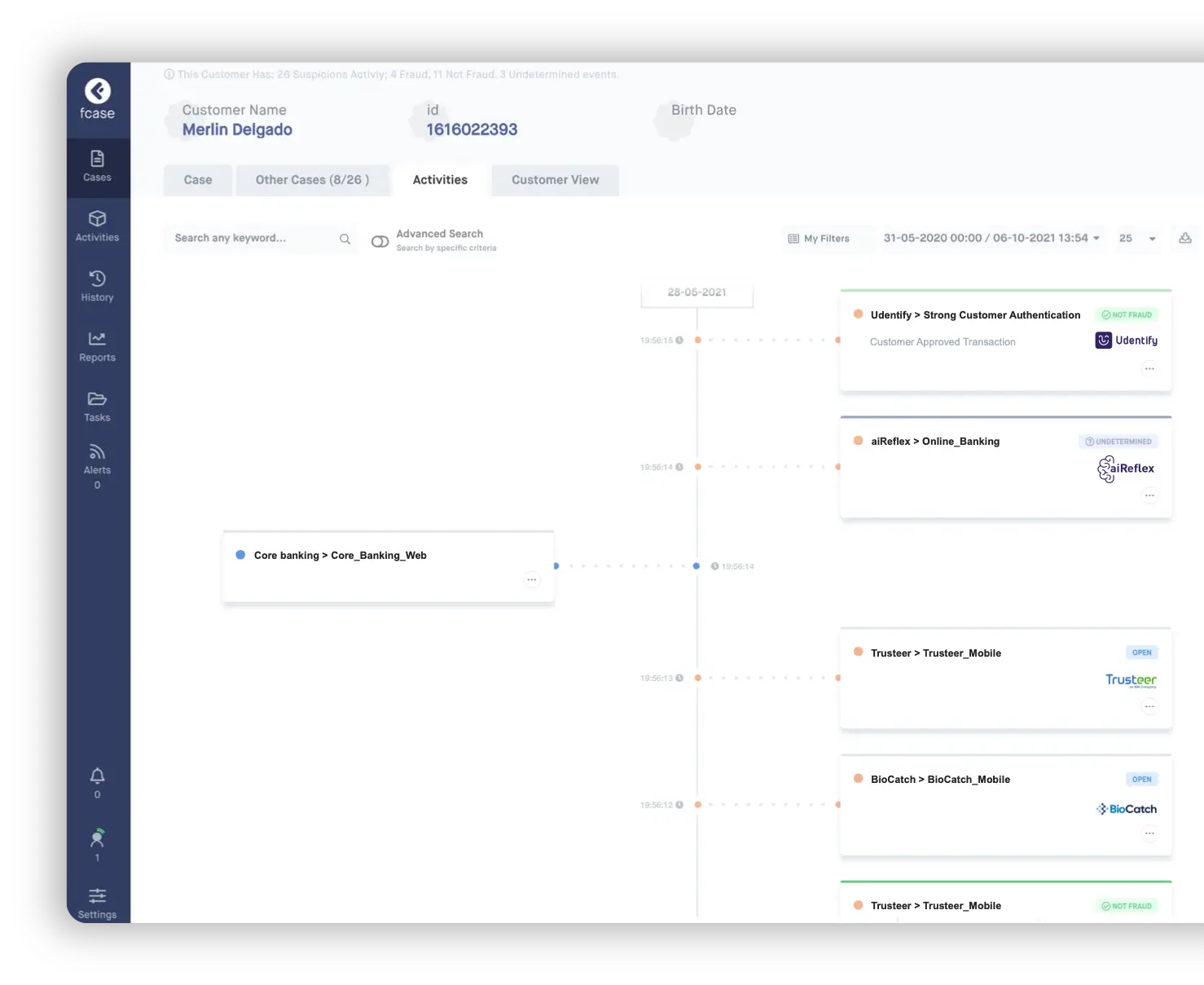

Case Management

+ Threat-centric cases

The downstream effect of threat-centric cases is a reduction of fraud cases, false positives; while delivering 9x greater investigation efficiency saving you time and money.

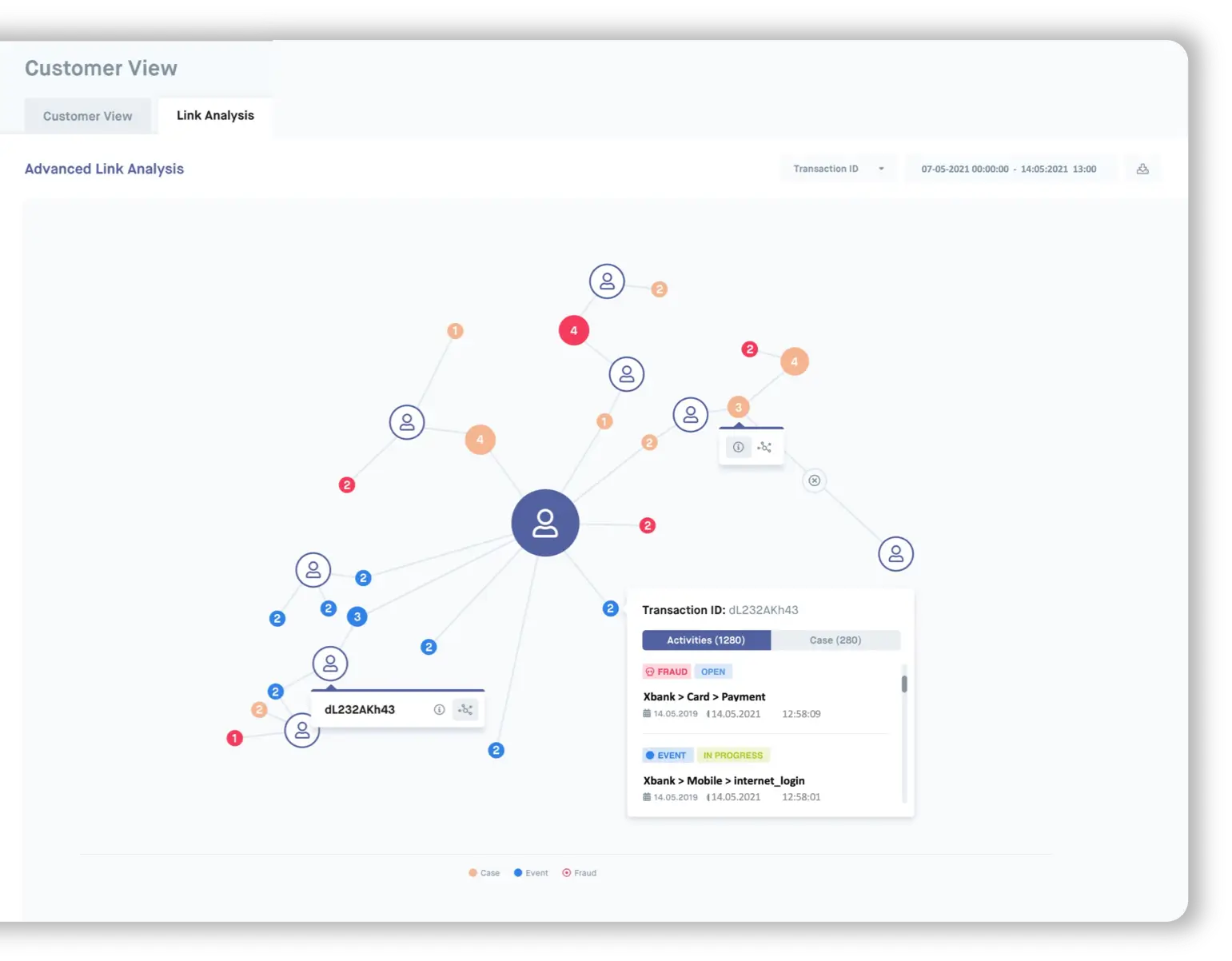

+ Advanced link-analysis

Discover fraud-rings, Synthetic Identifies, account takeover, online payment, promotion abuse, refund abuse, and so much more.

Our Link Analysis uses advanced graph-based techniques to display connections between any data points collected to supercharge your fraud investigations.

FAQ

aiReflex Risk & Trust Hub is a flexible application, event and transactional fraud detection platform that utilises machine learning and adaptive rules to stop fraud in real time for industries such as banking, insurance, and eCommerce.

At Fraud.com, we unite your fraud tools, creating a centralised defence that works in harmony, driving genuine customer risk and trust assessments powered by AI, transactional and journey orchestration and identity solutions that reduce your risk, improving customer trust and overall bottom line while futureproofing your fraud defence.

Contact us today to learn how we are helping businesses build the ultimate defence.

Our proprietary detection engines determine between genuine customers and bad actors in real-time using a combination of adaptive behavioural analytics, clustering and classification algorithms, and an ultra-fast in-memory adaptive rule engine to deliver a final risk score with explainable AI.

Risk and trust assessments are then managed via our fraud operations hub to drive customer journeys using all risk signals to improve fraud prevention and customer experience. Manual reviews are adaptively prioritised and presented by the threat to deliver extreme accuracy to

With aiReflex, IF you can imagine it (and you have the data!), THEN you can detect and prevent it.

Contact us today for a live demo to find out more.

Futureproofing fraud prevention requires unity, integration flexibility, central intelligence, and an adaptive approach to digital customer journeys.

aiReflex is a web-based AI application developed with Java, designed to unite your prevention and identity siloes at the speed you want, serving multiple institutions and business units within a single installation with a centralised fraud API, LDAP integration, and its multi-lingual too.

We use known frameworks, codes, libraries, and technologies such as docker and Kubernetes to speed up the development process and allow for better code maintenance and scalability.

Contact us today to learn more about the benefits of aiReflex Risk & Trust Hub.

Ready for the new era of identity, authentication and fraud prevention?

Our experts are here to answer your questions and help you with every step to make sure fraud.com solutions are suitable for your needs.

Complete the form on the right, and we will contact you back as soon as possible.