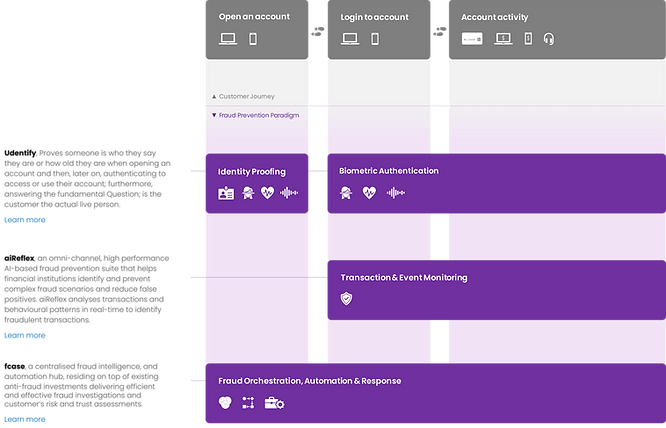

Discover our fraud Prevention paradigm and solutions for financial institutions

fraud.com develops technologies to help financial institutions tackle fraud through one unified solution. fraud.com offers user authentication, end-to-end fraud prevention, operations and management solutions that focus on the customer journey where enterprises can simplify their fraud management operations to deliver an improved customer experience.

Our technologies are designed to combat financial crime at digital enterprises in financial services, E-Commerce, Gaming, Health, Aviation, Hospitality, Government sectors. Our unified operations architecture combines ID Proofing, KYC, Biometric Authentication via face and voice recognition, Collective Intelligence, Rule-based decision engines, Machine Learning, Robotic Process Automation and Link Analysis to combat fraud.

Our Mission

To help enterprises tackle fraud effectively. All risks associated with fraud involve three kinds of countermeasures: identifying and authenticating the customer, monitoring and detecting transaction and behavioural anomalies, and responding to mitigate risks and issues.

The Fraud Prevention Paradigm

|

|

|

||||||||||

|

customer journey

|

|

|

|

|

||||||||

| fraud prevention paradigm | ||||||||||||

| Udentify: Proves someone is who they say they are or how old they are when opening an account and then, later on, authenticating to access or use their account; furthermore, answering the fundamental Questions; is the customer the actual live person? Learn More |

|

|

|

|

||||||||

| aiReflex: An omnichannel transactional orchestration and AI fraud detection solution, providing a definitive and final risk score to deliver precise and fair user experiences. Learn More |

|

|

|

|

||||||||

| fcase: A fraud orchestrator residing on top of your existing anti-fraud investments to deliver centralised journey-time orchestration, fraud investigations and fraud reporting. Learn More |

|

|

||||||||||