Every customer has a story

Every story has a journey

Every journey has risk

Our Unified Risk Operations solution for financial institutions

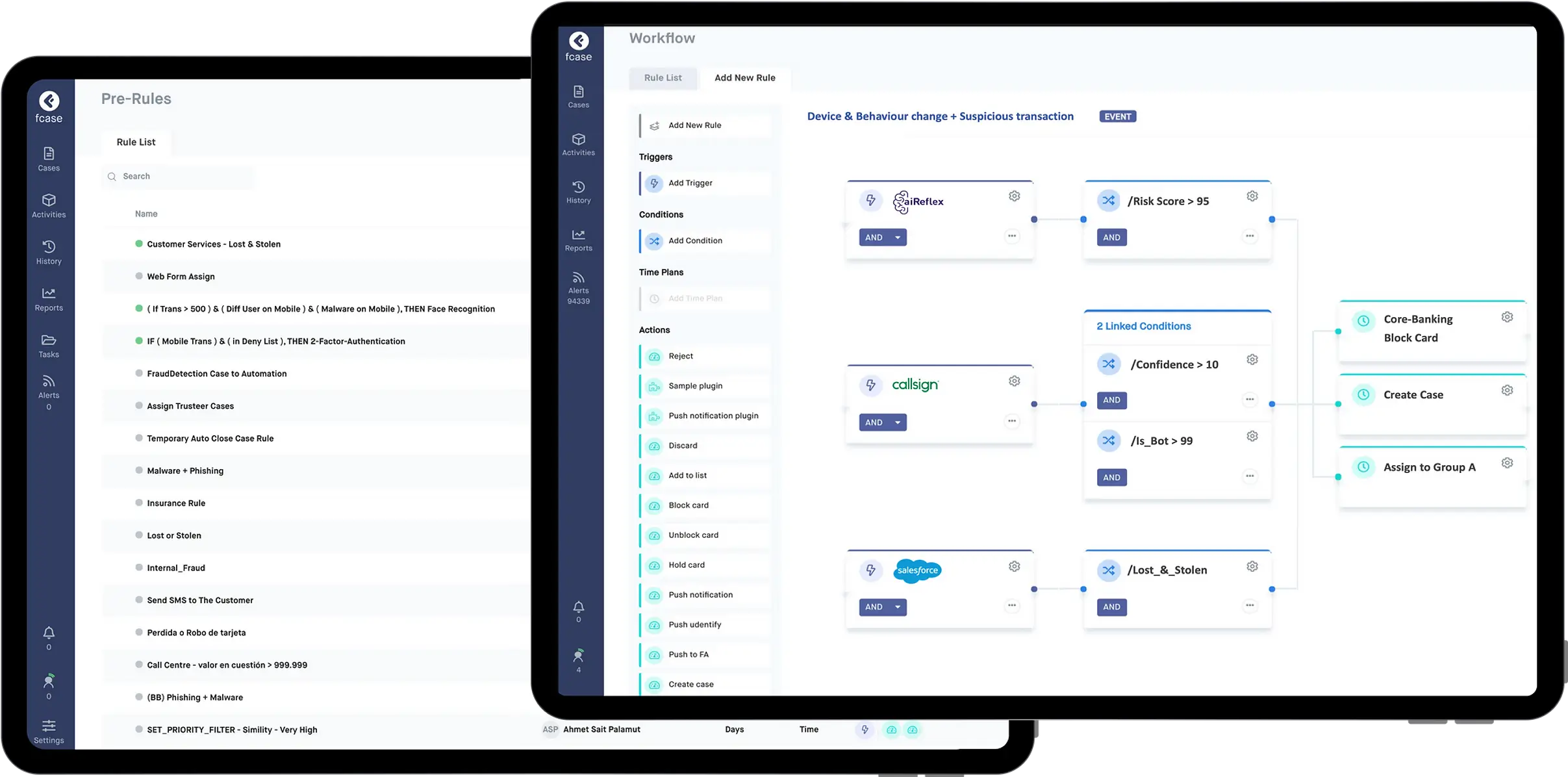

Centralised Fraud Automation

Forming a single customer view to Permit, Block, Check Manually, Evaluate Trust during the customer journey while driving fraud operational efficiencies

fcase intelligently manages fraud prevention response in real-time across your entire fraud and risk enterprise by uniting all your risks, customer and transactional systems, delivering a Continuous and Adaptive Risk and Trust Assessment of your client’s risk; further reducing fraud and customer friction.

The possibilities are endless.

Centralised

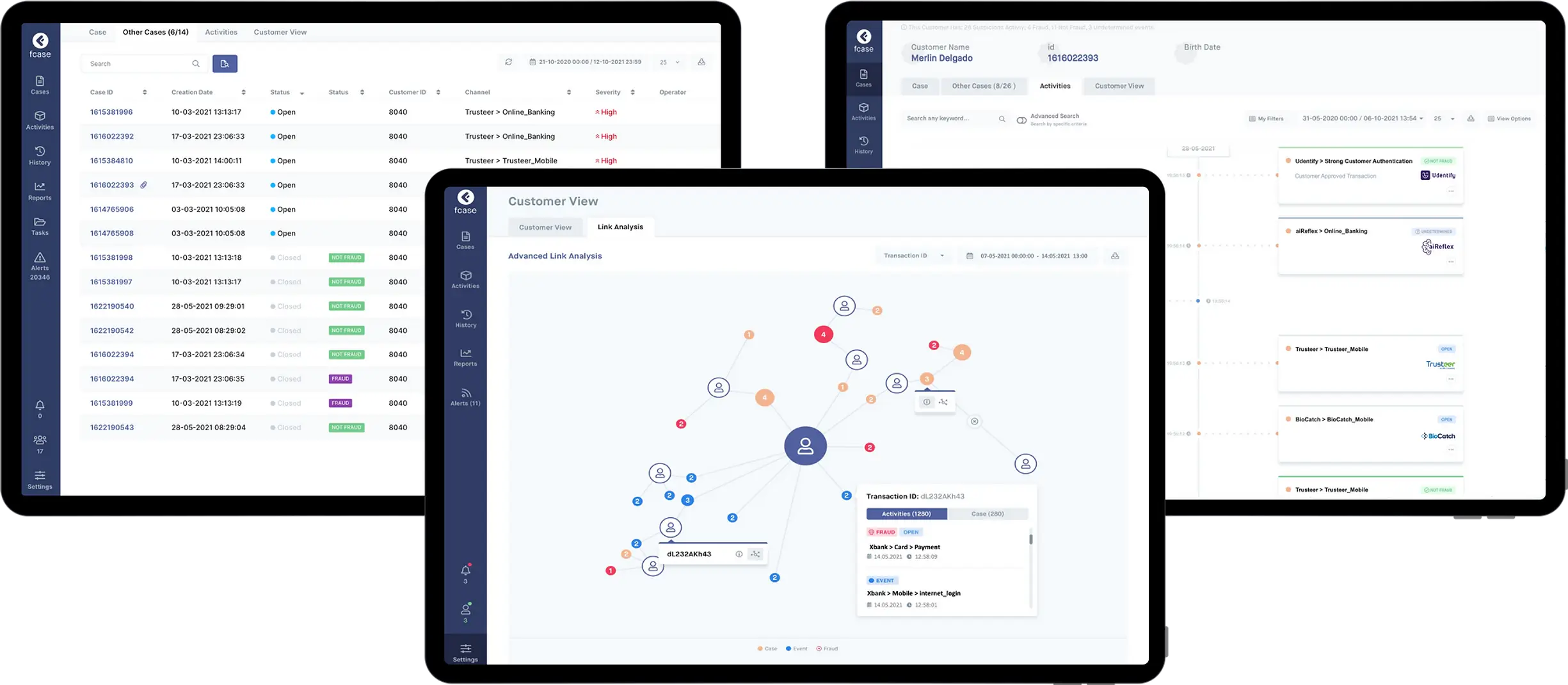

Case Management

fcase forms a common investigation platform across all your point systems such as anti-fraud and Cyber.

One final fraud prevention layer delivers a full picture of fraud, conducting the research and presenting the results automatically by threat, improving investigation accuracy and operational efficiency up to 9x.

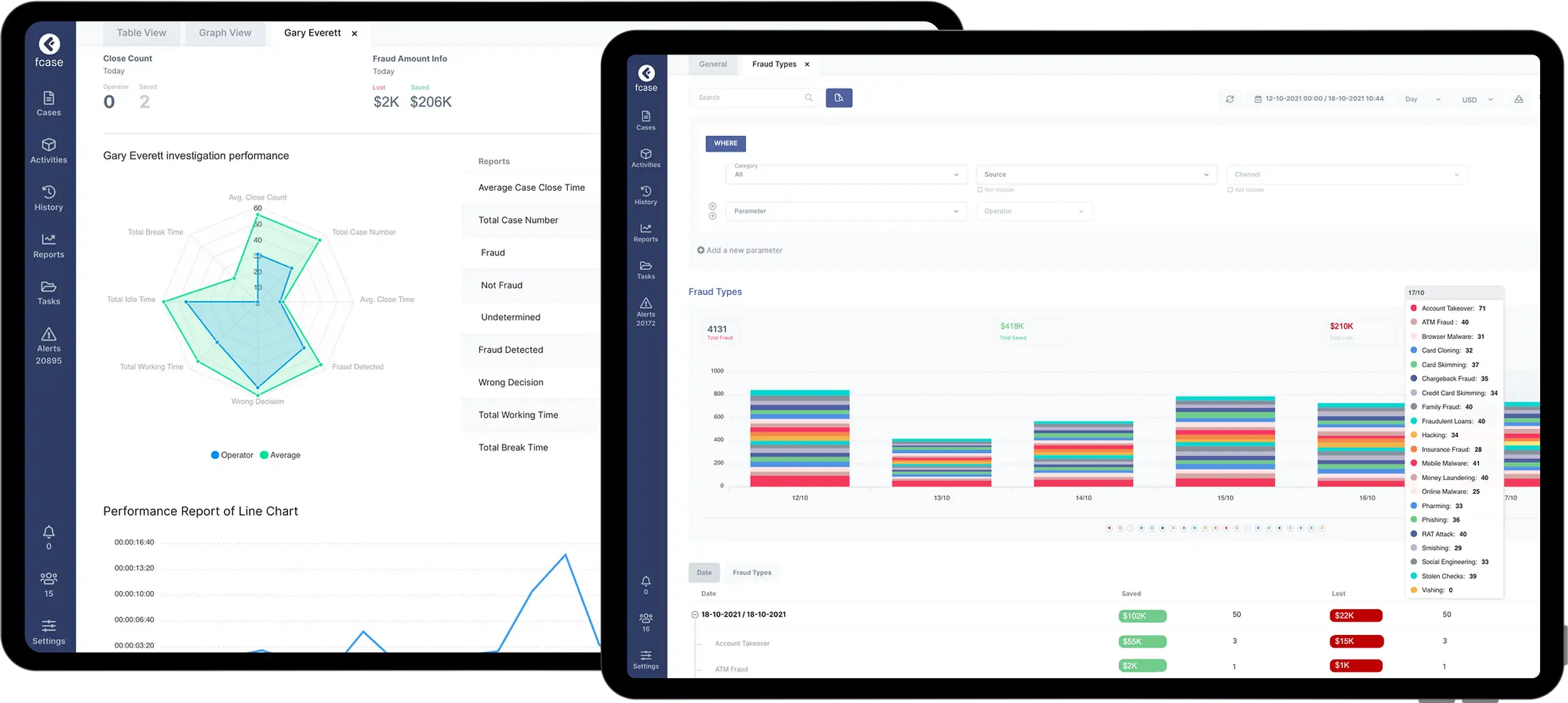

Centralised

Fraud Reporting

Delivering Extreme Efficiency

40%

20%

Reduction in fraud when enabling the full picture of fraud

90%

Improved fraud insight delivering enhanced decisioning

Boost your business

Unified risk operations

Fraud storyboards

Data orchestration

Fraud automation

Common fraud framework

Fraud APIs

Data is the core of everything, with one common fraud framework and APIs across your whole enterprise. The possibilities are powerful in the fight against fraud.

Fraud reporting

Smart loopback

Compliance Reporting

Scalability

FAQ

Fraud monitoring is the monitoring of all transactions to prevent fraud. This not only detects abnormal actions during the transaction, but also monitors all transactions in an account in any sectors (banking, insurance, game etc.) on the system, and allows you to classify and manage possible risks by tracking changes in personal data apart from transactions.

Fraud risk management; It is a development process that enables to identify potential and intrinsic risks, evaluate risks, and detect suspicious transactions to prevent fraud before fraudulent activity occurs.

fcase can create case models with the data obtained from this process with its AI-supported detection and management capabilities and deep learning algorithms, and connect different processes. this shortens the fraud investigation process and facilitates faster detection of future fraud attempts.

fcase allows you to automate and improve the fraud management process with regular tasks and checks for the KPI’s you set.

Ready for the new era of identity, authentication and fraud prevention?

Our experts are here to answer your questions and help you with every step to make sure fraud.com solutions are suitable for your needs.

Complete the form on the right, and we will contact you back as soon as possible.