In an increasingly digital-first economy, traditional Know Your Customer (KYC) processes, rooted in manual documentation, in-person verification, and prolonged approval timelines, are rapidly becoming obsolete. These outdated methods not only frustrate customers but also result in higher operational costs, increased customer drop-off rates, and greater vulnerability to fraud.

As customer expectations evolve and regulatory demands grow more stringent, businesses must rethink their onboarding strategies. Video KYC has emerged as a powerful solution, offering real-time, secure, and user-friendly identity verification.

In this article, we explore the key benefits of Video KYC, its role in regulatory compliance, and how businesses can successfully implement it to drive operational efficiency and customer satisfaction.

Table of Contents

ToggleWhat is video KYC?

Video KYC (VKYC) is a digital verification method that uses live or recorded video, along with AI tools like facial recognition, biometrics, document checks, and liveness detection, to securely confirm customer identities.

Financial institutions and fintechs use VKYC to speed up onboarding, cut fraud, and enhance the user experience. It replaces physical paperwork and branch visits with fast, remote verification that meets global AML and data protection standards.

By adopting VKYC, businesses reduce costs, accelerate customer acquisition, and stay competitive in an increasingly digital market.

KYC vs video KYC

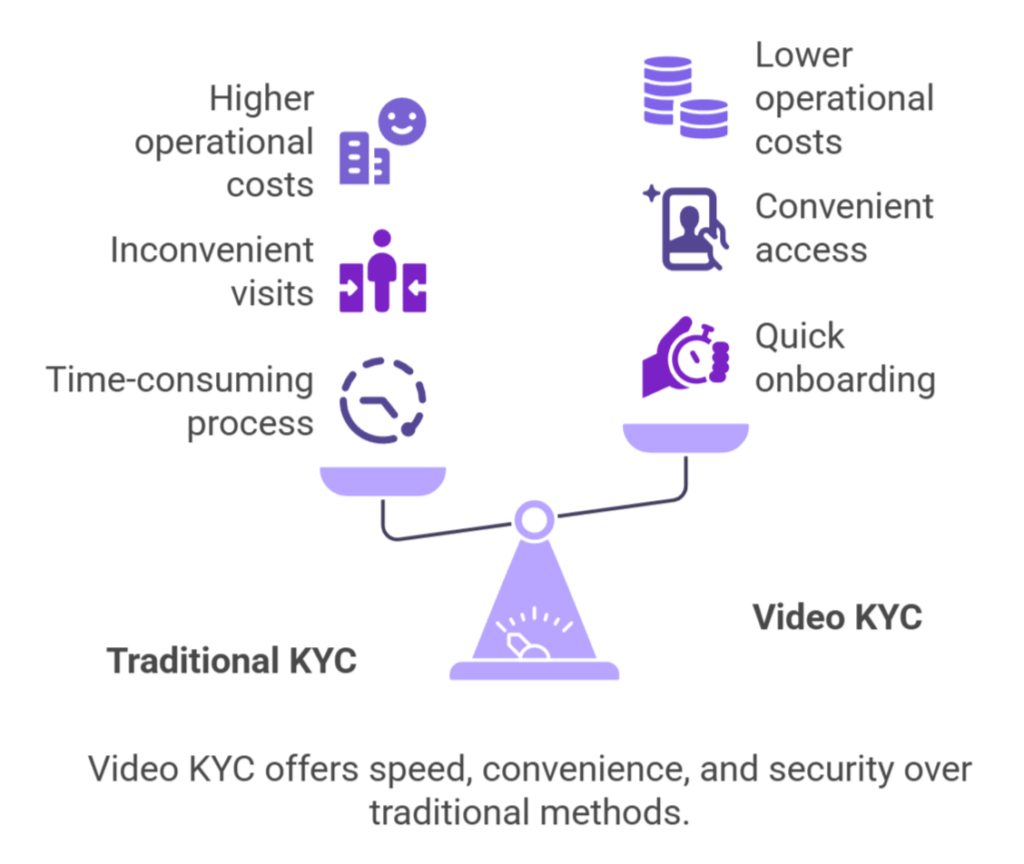

As financial services go digital, Video KYC is replacing traditional Know Your Customer (KYC) methods with a faster, more user-friendly alternative.

Traditional KYC is manual, paper-based, and time-consuming. It often requires customers to visit a branch, submit physical documents, and wait days for approval, leading to delays, higher costs, and increased fraud risk.

Video KYC, on the other hand, is digital, quick, and secure. Customers verify their identity via a video call using facial recognition, biometrics, and real-time document checks. It meets global compliance standards while delivering a smoother, more efficient onboarding experience.

Key differences:

- Speed & efficiency: Video KYC cuts onboarding time from days to minutes, helping institutions onboard more customers without compromising accuracy.

- Customer experience: By removing the need for physical visits, Video KYC meets customer expectations for convenience and instant access.

- Cost savings: Going digital reduces the need for physical branches, manual labor, and paperwork, leading to leaner operations and lower costs.

- Fraud prevention: Technologies like liveness detection and AI-powered analytics make Video KYC more secure and harder to manipulate.

- Regulatory alignment: Video KYC supports compliance with evolving regulations, offering robust data protection and audit trails through secure digital infrastructure.

How does video KYC work?

Let’s delve into the mechanisms of how the Video KYC process works to understand its operational framework:

Step-by-step process of video KYC

Initiating the session: A Video KYC session typically begins when a customer launches it through a mobile app or an online portal provided by the institution. Before proceeding, customers are often required to accept the terms and conditions related to data usage and verification. This flexible setup enables users to begin the process at their convenience, from any location, provided they have a stable internet connectivity, which is essential for uninterrupted video communication.

Identity verification: During the video call, the customer presents identification documents, such as a passport or driver’s license, and may be asked to confirm certain personal details. The verification officer reviews these documents for authenticity, while AI-powered tools simultaneously cross-check the provided information and validate the document’s integrity in real time.

Facial recognition and biometric authentication: As the session continues, facial recognition software compares the customer’s live image with the photograph on their ID. Additional biometric checks, such as voice and facial biometrics, offer another layer of protection, further verifying the individual’s personal details.

Liveness detection: To prevent spoofing and other forms of fraud, the system incorporates liveness detection. It may prompt the user to perform actions like blinking or turning their head, helping confirm the presence of a real person on the call rather than a static image or pre-recorded video.

Document and data validation: Throughout the session, the system validates identity data, along with the customer’s personal details, against official databases and carries out compliance checks. This step is crucial to ensure adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

Approval and onboarding: After successful verification, the system either approves the customer immediately or flags the case for further review. Once approved, the customer is seamlessly onboarded, concluding a secure, compliant, and user-friendly KYC journey.

Key components of the video KYC process

A successful Video KYC system brings together critical KYC technologies and compliance tools to deliver fast, secure, and user-friendly verification. Here are the core elements:

- Secure video interface: Enables real-time, face-to-face interaction between the customer and verification agent, adding a human touch to the digital process.

- AI-powered verification: Uses facial recognition, document authentication, and biometric checks to validate identities quickly and accurately.

- Liveness detection: Confirms the user is physically present with real-time prompts (e.g., blinking or turning the head), protecting against spoofing and deepfakes.

- Document verification: Automates ID checks using OCR and database matching to ensure documents are genuine and meet regulatory standards.

- Compliance integration: Built-in compliance features ensure alignment with KYC/AML laws, including audit trails, data protection, and jurisdictional requirements.

Together, these components make Video KYC a fast, secure, and compliant alternative to traditional verification.

Video KYC requirements

To run Video KYC effectively, businesses need the right mix of technology, compliance, and trained personnel. Here are the essentials:

- Reliable digital platform: Use a secure, user-friendly platform that supports video calls and integrates easily with mobile and web apps.

- AI and biometric tools: Leverage AI for real-time document checks, facial recognition, and liveness detection to enhance speed and security.

- Regulatory compliance: Ensure the system meets local and international AML and KYC regulations from day one.

- Secure data handling: Protect customer data with strong encryption and secure storage protocols throughout the process.

- Trained verification staff: Employ skilled personnel trained in fraud detection and video-based customer interaction to maintain integrity.

Meeting these requirements helps ensure a fast, secure, and fully compliant Video KYC experience.

Benefits of video KYC

- Anywhere, anytime access: Video KYC empowers customers to complete the verification process from virtually any location, eliminating the need for physical visits. This not only removes geographic limitations but also broadens access to financial services, making g more inclusive and user-friendly.

- Faster onboarding, less waiting: By digitizing verification steps, Video KYC dramatically reduces the time it takes to onboard new customers. What once took days can now be completed in minutes, streamlining operations and accelerating user acquisition for businesses.

- Built-in security at every step: Advanced security features, including AI-driven identity checks, facial recognition, and biometric authentication, are embedded throughout the process. These layers of protection make it far more difficult for fraudulent actors to slip through the cracks.

- Seamless compliance with global standards: Video KYC is designed with compliance in mind. It aligns with international regulatory frameworks such as AML (Anti-Money Laundering) and data protection laws, helping institutions stay audit-ready while safeguarding customer data.

- Scalability for growing businesses: Video KYC can handle high volumes of verifications simultaneously without requiring a proportional increase in staff or infrastructure. This makes it ideal for fast-growing institutions or those operating across multiple regions.

- Improved customer experience: The intuitive, guided nature of most Video KYC platforms simplifies the process for users, reducing friction and abandonment rates. Customers appreciate the convenience and speed, which boosts overall satisfaction and trust.

- Lower operational costs: Digitizing the KYC process reduces the need for physical branches, manual document handling, and back-office processing. This leads to substantial cost savings over time, especially for large-scale operations.

- Eco-friendly process: By eliminating the need for physical paperwork and in-person travel, Video KYC supports environmental sustainability. It reduces the carbon footprint associated with traditional verification methods.

- Real-time monitoring & analytics: Video KYC platforms often come with dashboards and analytics tools that help institutions track performance, detect anomalies, and gain insights into customer behavior, all in real time.

- Reduced human error: Automated document checks and AI-based verification reduce the chances of human oversight, ensuring a higher level of accuracy in identity validation.

Challenges and best practices in implementing video KYC

While Video KYC offers speed, convenience, and compliance, successful implementation requires addressing a few key challenges. Here’s how to navigate them, and best practices to ensure a smooth rollout.

Challenges

- Technical barriers: Users may face poor internet, incompatible devices, or clunky interfaces. Delivering a smooth experience across all devices and networks is essential.

- Regulatory complexity: Keeping up with shifting global and local compliance requirements can be tough. Staying current is critical to avoiding costly missteps.

- Data security risks: Video KYC involves sensitive information. Without strong security measures, systems remain vulnerable to breaches and fraud.

- User resistance: Not all customers are comfortable with digital processes. Clear guidance and support are key to building trust and ease of use.

Best practices

- Build a scalable and secure platform: Invest in tech that supports seamless, high-quality video interactions and integrates with your existing systems.

- Train verification teams well: Equip agents with skills in fraud detection, customer handling, and technical support to ensure efficiency and accuracy.

- Implement strong security layers: Use end-to-end encryption, secure APIs, and firewalls to protect data and verify identities.

- Stay ahead on compliance: Work with legal experts to align your process with the latest AML, KYC, and data privacy regulations.

- Support and educate users: Offer step-by-step guides, FAQs, and live support to help users complete verification confidently and quickly.

Addressing these challenges with the right strategy helps businesses deploy Video KYC that’s not just compliant, but also secure, scalable, and customer-friendly.

VKYC FAQs

| Section | Key Points |

|---|---|

| What is Video KYC? | Video KYC uses live or recorded video, along with AI tools (facial recognition, biometrics, document checks), to verify customer identities remotely. |

| KYC vs Video KYC | Video KYC is faster, user-friendly, and more secure compared to traditional, manual KYC, reducing fraud risk, costs, and onboarding time. |

| How Video KYC works | Steps include initiating the session, verifying identity, facial recognition, liveness detection, document validation, and final approval. |

| Key components of VKYC | Secure video interface, AI-powered verification, liveness detection, document verification, and compliance integration are core to the process. |

| Requirements | Reliable platform, AI and biometric tools, compliance with regulations, secure data handling, and trained verification staff are necessary. |

| Benefits of Video KYC | Benefits include faster onboarding, improved security, global compliance, scalability, reduced costs, eco-friendliness, and enhanced customer experience. |

| Challenges & best Practices | Challenges include technical barriers, regulatory complexity, and data security risks. Best practices: scalable tech, strong security, and user support. |

| Is Video KYC secure? | Yes, it includes AI-powered verification, facial recognition, and biometric checks to ensure security and prevent fraud. |

| What devices are needed for Video KYC? | Most smartphones and computers with a camera and internet connection are compatible with Video KYC. |

| Can Video KYC be used internationally? | Yes, Video KYC is designed to comply with global Anti-Money Laundering (AML) and data protection standards, making it suitable for use worldwide. |

| What if the verification fails? | If the verification fails, the case may be flagged for further review, and additional verification steps may be required. |

| How long does Video KYC take? | The process typically takes just a few minutes to complete, making it faster than traditional methods. |