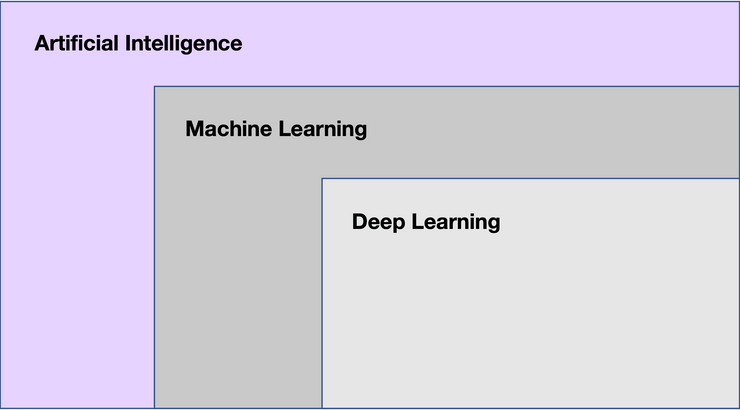

Machine Learning (ML) is a domain of Artificial Intelligence (AI) which leverages data and algorithms to allow software applications to ‘learn’ and adapt to new data and patterns without the need of a human, and therefore accurately predict outcomes to improve performance.

In simple terms, Machine Learning refers to the processes associated with a machine imitating human behaviour in an intelligent way, hence it’s a branch of AI.

Deep Learning is a Machine Learning technique, also known as Artificial Neural Network.

The following graph illustrates the relation between AI, ML and Deep Learning.

Table of Contents

ToggleMachine Learning in Financial Fraud Prevention

Banks and Finance Institutions are in a constant battle against fraud. They employ various methods within their Fraud Prevention techniques; Machine Learning is a very effective method, it can help you efficiently prevent fraud before it happens.

In connection with Fraud Prevention, there are machine learning algorithms which detect fraud patterns in financial transactions and decide whether a given transaction is legitimate or not. A machine learning model can identify and stop fraudulent activity in real-time and even before the financial transaction is committed.

The global fraud detection and prevention market is expected to reach $40.8 billion by 2016 and Machine Learning is a key part of this. ML is a very cost-effective solution that can help your organisation predict and recognise fraud patterns and attempts.

What are the types of Machine Learning?

The main types of Machine Learning algorithms used in anti-fraud systems are:

Supervised Machine Learning

Supervised Machine Learning algorithms require human supervision. Supervised Learning refers to the training of algorithms by using labelled data sets, meaning that the input data already has a correctly predicted output attached to it. It is called Supervised Learning because the training data can be seen as a teacher which supervises the machine’s earning process to predict the output correctly.

Unsupervised Machine Learning

On the other hand, Unsupervised Learning Algorithms do not require any human intervention or supervision. The model automatically builds clusters using the unlabelled transaction parameters. The use of Unsupervised ML in fraud prevention algorithms enables the detection of previously unknown anomalies or suspicious patterns

Top 10 Machine Learning Algorithms used for Fraud Detection and Prevention

Below Machine Learning Algorithms are ranked based on the frequency of academic publications applied for fraud detection. Each Machine Learning algorithm is classified based on the type and then benchmarked in terms of accuracy, coverage, and cost variables.

| Algorithm | Type | Accuracy | Coverage | Cost |

|---|---|---|---|---|

| Artificial Neural Network | Supervised | Medium | Medium | High |

| Decision Tree | Supervised | Medium | Medium | High |

| Support Vector Machine | Supervised | High | High | High |

| Genetic Algorithm | Unsupervised | High | Medium | Low |

| K-nearest Neighbour | Supervised | Medium | Medium | High |

| Bayesian Network | Supervised | High | Medium | High |

| Hidden Markov Model | Unsupervised | Low | Low | High |

| Logistic Regression | Supervised | High | Medium | Medium |

| Random Forest | Supervised | High | Medium | Medium |

| Naïve Bayes | Supervised | Medium | Medium | High |

Accuracy

The algorithm achieves high classification accuracy. Meaning the ratio of the number of correct predictions to the total number of input samples.

Coverage

The algorithm achieves a high fraud capture rate (True Positive Rate) combined with a low false-positive rate.

Cost

Refers to computational complexity. The algorithm is efficient in terms of cost and time.

What are the advantages of Machine Learning in fraud prevention?

Fraud is a major cause of profit loss for many organisations, especially those which have daily transactional events across different channels, such as banks, financial institutions and retail companies. The increase in fraud threats also leads to higher customer friction and harmful damage to customer loyalty.

There are several advantages of employing Machine Learning methods, including:

Scale, Speed and Automation

Machine learning-based fraud prevention systems, can handle billions of transactions and respond in real-time with absolute accuracy. The ability to work and respond in real-time allows the fraud detection system to compute a risk score during a transactional event in less than 100 milliseconds.

Reduced Operational Costs

Fraud detection using machine learning requires less manual labour. As the amount of data and experience increases, the results of machine learning become more accurate.

Continuous Fraud Detection

Machine Learning systems never stop learning and can detect new fraud scenarios and patterns quickly and accurately, helping organisations stay up to date.

What are the challenges of Machine Learning in fraud prevention?

Inadequate Data Infrastructure

Machine learning works by learning from data. In the case of supervised machine learning, labelled and cleaned data feed is required. Organisations without the required data infrastructure may suffer from implementing fraud detection systems utilising Supervised Machine Learning. Organisations with no data infrastructure should utilize Unsupervised Machine Learning as it doesn’t rely on historic data.

Some fraud prevention systems can apply both methods, supervised and unsupervised ML algorithms, to have wider and more effective anti-fraud operations. A leading fraud prevention system, aiReflex, combines a variety of machine learning methods in one system to be more effective than a single method alone.

Diverseness

In fraud detection, there is no one size fits all machine learning algorithm that works. Depending on the Industry, channel, context and transaction parameters, different machine learning methods, variations, combinations, and data sets are required. As things change with new data, fraud detection models must be adapted over time. A team of data scientists is required to design and maintain the model.

Explainable AI

Machine Learning models usually do not explain their predictions. Explainable AI refers to a set of techniques and design principles that adds transparency to the model to justify its prediction, this approach is also known as “White-box AI” or “White boxing”. While 100% explainable AI does not exist yet, there is an ongoing effort to develop white-box models that can explain how they behave, and how they produce predictions. There is a growing need for explainable AI as some regulators started to enforce explainability in Machine Learning.

How to choose an AI-based fraud detection system?

A machine learning model with the best performance is not always the best solution, there are several other factors to consider before choosing the right solution for your organisation. Here are some important factors:

Performance

The quality of the model’s results is a key factor when choosing a model. Some of the most popular performance metrics are “accuracy”, “recall”, “precision” and “f1-score”. However, not every performance metric gives a good insight into every scenario. If you are working with imbalanced datasets, “accuracy” will not be suitable to evaluate your model’s performance.

Explainability

As covered above in detail, Explainable AI is one of the key requirements in most situations. If Explainable AI is a significant criteria for your business requirement you should go with explainable techniques such as Clustering or Classification Algorithms (Linear Regression, Decision Trees, KNN). On the other hand, Artificial Neural Networks will not be able to satisfy your explainability requirements.

Available Data

The amount of historic data available for training is one of the key factors you should consider when choosing your model. In the case of no available data for that specific channel, you can start with an Unsupervised ML Algorithm and then use that data to design Supervised ML models later.

If you have small sets of training data, KNN Model could be a good start. Depending on the problem, you can design a good solution with 200 training data but sometimes you may need 50,000 training data. So, you should consider the availability of your historic data before choosing the right fraud detection system for your organization.

Time & Cost/Budget

Budget is always the most significant trade-off in choosing the right fraud detection system and its implementation. Consider the following table demonstrating the data scientist’s effort to fine-tune the ML model with target accuracy, bearing in mind that model accuracy refers to the metrics which determine which model is more effective at identifying patterns in variables in the datasets.

| Model Accuracy | Time to Design and Train | Cost |

|---|---|---|

| %99 | 2000 Hours | $200,000 |

| %98 | 1000 Hours | $100,000 |

| %97 | 200 Hours | $20,000 |

Which ML Model would you choose? Certainly, the answer depends on your requirements. But you should always consider balancing performance, time, and cost with respect to your business requirements and resources.

Model Inference Time

The time required for a model to make a prediction based on several data points to produce a score is called Model Inference Time. Imagine a credit card payment or Login transaction where the model is expected to make decisions in real-time, therefore any model that exceeds expectations won’t be suitable. Below you can see a simple comparison of two different models with respect to Training time and Inference time.

| Algorithm | Training Time | Inference Time |

|---|---|---|

| KNN | Lower | Higher |

| Decision Tree | Higher | Lower |

As you can see a Decision Tree model will have a lower Inference time than KNN however it will require more time during training.

Prioritise your fraud prevention needs when deciding which ML methods to employ

When it comes to Fraud Prevention, organisations adapt to and employ Machine Learning systems that can deliver a powerful, cost-effective, and real-time solution before fraud takes place. However, based on personal preference data scientists insist on their favourite ML model, which is usually one they know the best and delivered effective results in the past.

While being in the comfort zone is important, there is no single model that fits into every single fraud scenario, especially as fraudsters have ever-changing and sophisticated techniques which fraud prevention systems should adapt to keep up with all patterns and prevent fraud. Machine learning applications in fraud prevention should always be context-aware and flexible in terms of Model selection. AI-based fraud detection solutions should provide Algorithm selection flexibility depending on the real-life transaction scenarios considering user experience and journey.

Machine Learning for fraud detection with aiReflex

Machine learning for fraud detection is significantly important for businesses to stay ahead of cyber threats and fraud. With aiReflex businesses can take advantage of this technology to detect and prevent fraud. aiReflex uses sophisticated machine learning algorithms to continuously monitor transactions and detect suspicious activity. It can detect patterns and anomalies in transaction data and identify suspicious transactions, while also that legitimate transactions are not blocked. It is also capable of learning from its own experiences, meaning it can detect new threats and adapt its algorithms to become more effective over time.

The platform is easy to use, with a user-friendly interface, allowing businesses to quickly set up and configure their fraud detection system. Furthermore, aiReflex provides a range of support services and regular updates to ensure the system remains secure and up to date. With aiReflex, businesses can be confident in their fraud detection capabilities, enabling them to protect their customers’ data and their bottom line.